Wonder's COO Tony Hoggett Talks Grubhub, Relay, Blue Apron & Super App Ambitions

Ambitious startup doubles down on "content" with Tastemade

The food delivery industry certainly doesn’t suffer for excitement, between big brands being bought and sold, regulatory battles over courier pay, skirmishes over curb access and real estate in big cities. Wonder has been particularly central to that conversation, starting with its flashy launch and pivot in the tri-state area, followed by bold moves like buying up Blue Apron, Relay and Grubhub, and even this week’s news that the company is getting into entertainment, thanks to its purchase of Tastemade.

Key to this sprawling strategy is one particular man, Tony Hoggett, who joined the Marc Lore-helmed mega-startup after an impressive career at Tesco and Amazon. I was lucky enough to sit down with him to get a glimpse of his vision for the future of dining and delivery.

Hungry for even more insights into the future of delivery and mobility? Join us at Curbivore on April 10-11, and meet with leaders at DoorDash, Wing, Uber Eats, Wendy’s, Shell Recharge, indiGO, Sweetgreen, Rideshare Carz, Revolution Carts, Perch, Serve, Zipcar, Zoox, Coco and many more. Register now, prices jump Friday!

Jonah Bliss: Let’s start with your very storied career… how exactly did you get here?

Tony Hoggett: I’ll give you the couple of minute version. You've seen that Wonder very recently has made quite a number of hires. Marc [Lore] and Jay and others are building a very strong team. Whitney joined from Walmart and Courtney joined from Wayfair and I've recently from Amazon. I spent all my life moving and selling food and groceries, with 30 years at Tesco. I've always led technology teams as well as operational team, but then I was CEO of all of our Asia business, thinking end-to-end from customers to operations. Then Amazon called me in 2021 and said “We're going to build the biggest grocer on the planet. Would you to come and lead it?” That was my first intelligence test, and of course the answer was yes and I loved my time at Amazon. The innovation that's coming through there in grocery and on moving and selling is awesome.

I connected with Marc 18 months ago, and we had been in different circles when I was running commerce at Tesco and Marc have been building Jet and then Walmart ecommerce. I started to chat with Marc about what we're building at Wonder, and I firmly believe our talk about building “the super app for mealtime” and making great food more accessible, which is fundamentally what I've grown up trying to do: make great high quality groceries and food more accessible to more people as well as hiring and building big business.

And so, there’s just massive overlay to what we're trying to do here at Wonder. And I genuinely think anywhere there's a big and emerging customer spend and where the current level of service with the incumbents is below par, I can see where Wonder's solved it, and we have a model that customers love already. Now, we've got an emerging model that makes sense economically and really it's now time to scale. I couldn't have joined at a more exciting time for the company.

To your point, everyone eats and there's got to be a better way to do it. With that said, what's new at Wonder?

If you think of the Wonder business being around brick and mortar restaurants for a couple of years now, we just opened our 38th last week, with another 55 planned this year. That is core to the business. Every one is doing better than the last; we're learning as we're going along.

We developed 25 restaurant concepts. We're working out how we best put those 25 in which size space. You can't fit all 25 in each physical space, we're continuously trying to configure those and that's super exciting. You've seen we acquired Grubhub, which is a big integration opportunity, both for customers and operations. We've fully integrated now Blue Apron onto the front end app and we've now fully integrated Relay into our last mile courier business.

If you think of the traditional model of customer acquisition and then the buying, the making, the moving and the selling, we've really got all parts vertically integrated now for us to serve customers better with the best selection at great prices with the best convenience: selection, price, and speed. We’re building more choice and creating more content, whether that's restaurant content, whether it's fine foods with Bobby Flay Steak, or fast casual with Limesalt, and with Royal Greens.

Trying to serve that customers more conveniently than ever is a core plan for us. Blue Apron also adds another feather to our cap, as we've already got all of the prepared food, but there's also the meal kit opportunity. And the integration at the front end is new, making it seamless for customers to be able to order food now or food for later or food that's already cooked or food that I need to cook. And that's just a super interesting blend on being able to order those from the same app with super fast delivery. What’s super interesting to me is getting more and more of that share of stomach, whether it’s by meal occasion throughout the week, whether it’s lunch or dinner, we're continually touching all of those bases.

What was it about Marc Lore's vision for the company that attracted you?

Most business people don’t get many opportunities to work with someone like Marc. His energy is super infectious, as is his proven track record and his ability to think far into the future. His appetite for risk is like nothing I've ever worked with, in a positive sense. He is just like no one I've ever worked with and one of my passions is to continue to learn and develop myself.

I've always loved thinking about the share of stomach…. affordable groceries, reach, scaling, end to end value chains and operating models. That was a role Marc needed at Wonder and I've always used technology to solve quite complex problems, while building for customers.

Tony: And that's what we essentially needed to do. So, in short, both personally and professionally, Marc and I seem to grow good connection with a shared vision of how this space of food delivery could be improved hugely for customers over time and be very valuable for a business that could do that.

When Wonder says it's “building a super app for mealtime,” what does that mean to you?

It’s a number of things. If you come back to what customers are really looking for at meal time, it's choice and content, it's value for money and it's convenience. And this super app is bringing together the best content possible from fast casual burgers or a Bobby Flay steak or tenders for the kids, a pizza, or some slow-cooked rib… we've got you covered. And that's very unique. Adding in meal kits across breakfast, lunch and dinner allows you to cover your cost bases. We can serve you whatever your budget.

Fundamentally, bringing those 20 plus restaurants together in one super fast delivery is super unique: last week we had an under 30 minute average delivery time. “What do we all want to eat?” The chances of everybody saying the same thing in a five person household are low and Wonder unlocks so much friction at home which others just cannot do because the platforms out there don't have their own content, they just cannot control the restaurant choice and they can’t control the quality of that food. We're very, very focused on having an unreasonably high bar for food quality.

Second, because of our knowledge of our customer base, we will know customers better than anybody. At a traditional app, the restaurants have all of their own data, the platforms have all their own data, and it's not connected. We have much more behavioral and real-time POS data on our customers and the level of service we're giving them in real time. Our ability to use AI and predict and offer you both inspiration and relevance will take out the need for you to think about what you want to eat tonight. We will know better than you what are your favorite dishes, the ones you've ordered more often than not. We can serve you based on your health profiles, your budget profiles, your family size profiles, what you eat every payday…

And over time as you trust us and that will allow more of a “push and serve and offer relevance” model than a “pull and search” model. People on average eat 21 meals a week; maybe we could deliver all of those 21 meals right on time, with all of these meals and meal kits hitting on your health or budget or family or other reasons you decide on which meals you eat at what time.

I never thought of the meals as “content,” but I understand the analogy.

It's more like selection. Whether it's the Amazon selection or the Netflix content, if you've got the best content and you can serve it up in a more relevant way that people can get more value out of that content and then deliver it incredibly fast at great value for money, then you can do quite well.

The company's made some interesting pivots and acquisitions in the last couple years. You jettisoned the cooking trucks and now you’ve gone all in on malls and food halls, bought Blue Apron, Grubhub. How does it all get glued together?

It's still early days, we're still sort of working it out. But if you come back to having great selection and great prices, delivered or picked up super conveniently, then we're in a really good space. If you think about the simplified end value chain of buying, making, moving and selling… we own the vertical integration of that. We're focusing on professionalizing the way we think about buying proteins and produce and hand-goods; we've got incredible technology both centrally as well as in the restaurant itself.

We've got a big plan on making food way simpler than anybody else can at such a high quality and low cost: that's really where some of our unique IP sits. It's our ability to serve 20 restaurants in 2,000 square feet, that's super unique. And then in the way we think about transport integration, both middle mile and last mile with Relay, there’ve been big investments on the way we think about point-to-point delivery. If you take Relay as an example, one of the reasons that we are able to keep food incredibly warm and delivered incredibly fast is because we are integrated with Relay. For the vast majority of orders, the restaurant is close to the customer so we don't need to bundle you with four orders. You've seen on some platforms where you order your food and it's zigzagging around the neighborhood going to three people before it gets to you.

Just getting colder and colder.

Yeah, colder and colder. We take our delivery promise really seriously. We give you that ETA of when your food's going to arrive, we're over 98% accurate on that. We have a very high bar for that ETA and the customer promise on delivery. And then if you think about the way we're selling on both the front-end platform as well as the service within the restaurants we've got big plans. And when you bring all that together, we really are early on in the phase… but we've really solved the demand. We've got a very strong customer demand. We've got a very strong operating model which should be really good as we continue to scale.

You've taken Blue Apron, Grubhub and Relay, which all had their own existing delivery infrastructure and different models. Are you now using the logistical infrastructure for all of them?

No, we're not, both on the front end and the operating model. The great thing about having all of that is you can be very choiceful about when it makes sense and when it doesn’t. We don't have some, large single silver bullet integration, at least not yet. In fact, from experience, I think oversimplifying these things can leave value on the table. The great news is we bring some incredible customer service and customer experience from Grubhub, the same as we do from Blue Apron. And we've got a great customer experience in Wonder and we’re bringing all of those together.

We think however a customer wants to engage with us, whether it's through the Blue Apron app, or Blue Apron through Wonder or the Grubhub app or through the Wonder app, we're happy to serve customers on the front end however they want to shop.

On the backend, we're always looking at ways to simplify technology architecture and where there's no point having three services that are all doing essentially the same job, there's the obvious way of streamlining core technology, systems and tools.

On the courier side the great thing is that we just use the best of both. Grubhub today hands off orders to Relay for them to deliver and we also use Grubhub on the Wonder side and we'll keep doing that where it works best for customers. Wherever the courier is closest to the restaurant, that delivers the food fastest, they will win. And the great news is now we have the visible data of that total couriers on the ground versus just one or the other.

Grubhub was in many ways the original face of restaurant delivery in the U.S. and then the last few years fell behind DoorDash and Uber Eats. How do you plan to rejuvenate the brand?

I think we'll come back to you on that, it's super early days. We only closed the deal a month ago really, and Howard is doing a great job as CEO. It was very public that JET had Grubhub up for sale and in the last few years I would say any context of that business was always under the umbrella of “it's up for sale” and now it's definitely not up for sale. We love having Grubhub as part of our family and Howard and team are definitely an asset to add to Wonder. So, watch this space.

Do you think there's a bigger opportunity for Grubhub in winning over restaurants again or winning over consumers?

I would always say consumers. If you obsess about winning customers or consumers then everything else can work its way out.

The answer to that might be the need to improve restaurant content, but fundamentally obsessing about the customer and what their needs are will win every time. And that is Howard's plan.

During your stint at Amazon, the company made a name for itself with some cool tech-forward initiatives like frictionless checkout. Grubhub also has some impressive technology, like delivery robots from your partners. What role do you see for labor-saving innovations broadly?

Anywhere you're paying labor hours that isn't really value-add, that you don't make the most of… it's not great for them and it's not great for us. I always hunt out those three Ds: dangerous, dull and dirty work that have already proven automation solutions.

Same with distribution where you have automat automatic putaway. Already in our restaurants, we've got conveyors moving food from the hot area through to the prep area and expo.

Where you've got travel time or dull work or repetitive work, those are always the low-hanging fruits for us. The team have already done a great job being able to produce a very high quality Bobby Flay steak and cook it in super fast time with the end product being indistinguishable between a freshly cooked steak and a fast-cooked restaurant Wonder steak. We'll continue to invest in automation where it takes out travel time, low value-add work, administrative or repetitive tasks. And then on the positive side, it’s how do we continue to invent cooking food faster without lowering the bar at all. In fact, we’re raising the bar on food quality and speeding up its production. And we've got lots of exciting things coming down the line…

Going out on a fun note… I'd say throughout your career, you've run groceries and giant food brands really the world over: the U.K., China, Turkey, India, America and more. What are some of the most interesting differences between those markets?

Super interesting question. I would say in my world there's more common than different which is super interesting…

Everyone eats.

And everybody's got goals whether it's health, budget, family. And the world over, if you obsess around understanding your customers really well, and serving them better than anybody else, you do really well. It does come back to having great selection that's relevant for your customer base. It's great value for money and excellent customer experience.

I would say that the differences are just the stages of technology that are being used. I've worked in businesses in South Korea, Thailand, China, as well as Europe and now the US. When I started in the early 2000s working in Asia, front-end technology, even e-commerce was behind what you might find in the US. And now many countries have leapfrogged.

When I was in China, I would look over to the west for inspiration. And I find myself in recent years looking over to Asia for inspiration. One example is if you go to Shanghai the thought of even credit cards — forget cash — but if you get into a taxi, even going back 10 years, they went straight into digital payment. So they're all catching up, but they're all at slightly different stages.

Sounds like they're going to eat our lunch, no pun intended.

We're doing pretty well though. I think what we're building in Wonder, I've not seen anyone in the world doing what we're doing. We're building real content with real brands with real chefs with incredibly incredible high quality food.

You can walk down the street and walk in and order any of those foods in real time and walk out with them or sit in. We haven't seen that anywhere else in the world.

Hungry for even more insights into the future of delivery and mobility? Join us at Curbivore on April 10-11, and meet with leaders at DoorDash, Wing, Uber Eats, Wendy’s, Shell Recharge, indiGO, Sweetgreen, Rideshare Carz, Revolution Carts, Perch, Serve, Zipcar, Zoox, Coco and many more. Register now, prices jump Friday!

HOT INDUSTRY NEWS & GOSSIP

Hyundai picks Avride: Avride has been on a tear as of late, teaming up with Uber Eats and launching in new markets. Now its full-size AV ambitions are getting a boost thanks to a new partnership with Hyundai. That definitely doesn’t bode well for the folks left working at Motional…

Carsharing down under and up over: Uber partners with Mevo and GVI in Australasia to offer rentable EVs for couriers and drivers on-platform. Meanwhile in Norway, Hyre hits profitability off €34 million in revenue.

Ancient transport! No not gas powered cars, not even the horse and buggy… researchers have found evidence of early transport technology in New Mexico’s White Sands National Park. Called a “travois,” the system allowed for dragging heavy goods before the invention of the wheel.

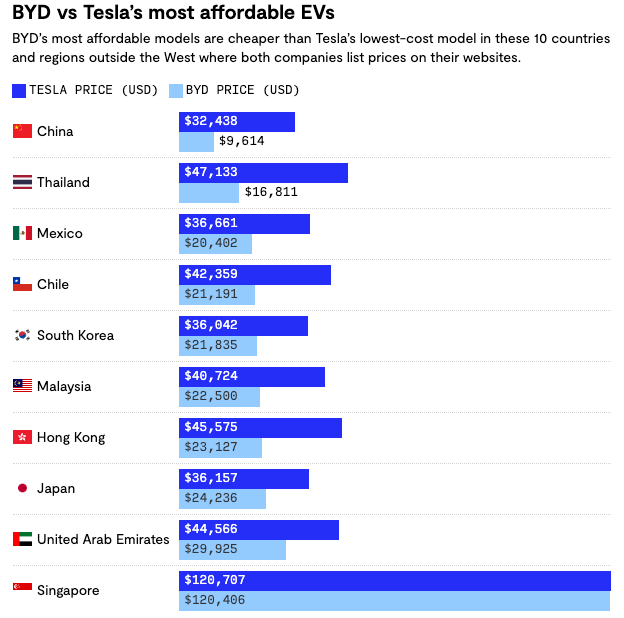

Geely takes over the world: Chinese automaker Geely is entering Australia and New Zealand, with plans to enter UK, Brazil, and South Africa to follow. With no domestic car industry of its own to protect, Australia has really welcomed Chinese car brands, creating a boon for local consumers. While America (and to an extent, Europe) instead choose protectionism, this handy chart on EV prices shows how much cheaper Chinese manufacturing can be.

This week in national shame: HUD cancels gov’t capacity-building contracts, raising the cost of home building. DOT removes equity and environmental factors from ILJA funding. USDOT to “review” all green infrastructure and bike projects. EPA decides it does not, in fact, want to regulate pollution.

Market variations: A new report from Gridwise (more below) finds some interesting variations in ridehailing, on a market by market basis. Note the high discrepancies in pay… why bother with robotaxis in Houston when the humans work for so cheap?

PARTNER | Autonomous Vehicles Are About to Transform Rideshare – Here’s What You Need to Know

Autonomous vehicle firms like Waymo, Zoox, and Cybercab are set to reshape ride-hailing and on-demand delivery. But how will these firms tackle key challenges like market selection, optimizing fleet deployment, and balancing pricing strategies to maximize demand and profitability?

Together with S&P Global Mobility, Gridwise Analytics has compiled a must-read report detailing the key insights every mobility leader needs to know.

Key Findings:

Autonomous ride-hailing trips are growing fast, but AV pricing must hit $1 per mile to scale.

Fleet efficiency is a major challenge—AV fleets need to average 12-15% dead miles, but even the best ride-hail fleets operate at 20-22%.

Demand and pricing vary dramatically between and within cities, making fleet optimization complex.

Pooled rides are making a comeback, now at 1.7% of total rides (Sept 2024)—but still far from the 12-19% pre-pandemic levels.

Get the full report now to understand where AVs are headed.

A few good links: Coco Robotics announces collab with OpenAI. Cities in CA, CO and WA go all in on curb management. Has Volocopter found a lifeline? Defense spending may offer new growth for European startups. Walker Consultants seeks curb management expert. It’s electric expands in Boston. SoCal-based aerospacer Karman hits $4B at IPO. Dance raises €12 million. Northvolt bankrupt. Open Philanthropy spending $120M to support YIMBYism. Nashville outlines new transport spending plans. VTA strike drags on.

Get your Curbivore tickets!

- Jonah Bliss & The Curbivore Crew