Will Fed Tinkering Reopen The Mobility IPO Window?

Analyzing Turo's Q3 results and the history of p2p carsharing

Calling all speakers – who do you think is at the forefront of mobility, transportation, curb management, restaurant / retail tech, delivery or civic policy? Nominate someone to speak at Curbivore 2024. Think big people, we want to hear your most interesting ideas!

Yesterday the Federal Reserve held interest rates steady, while signaling that they’re likely to come down three quarters of a percentage point by the end of ‘24. That’s likely welcome news to anyone trying to get a mortgage, but it may also be a boon to the mobility technology space. While tech of all stripes has been battered by the higher interest rate environment, capital-intensive mobility and transportation companies have been especially affected by the associated cooling of the VC market.

Seed funding for new startups has gone down a bit: $3.1 billion in Q1 ‘23, compared to $5.6B in Q1 ‘22 and $3.5B in Q1 ‘21. But late stage funding and exits have really taken a blow: as we close out 2023, there have only been 150 IPOs, compared to 181 the year prior and a whopping 1035 in 2021; you have to go all the way back to 2016 to find a time when so few companies managed to go public.

While Instacart did manage to squeeze out an IPO a few months ago (and has treaded water since,) a number of other mobility and delivery companies are waiting in the wings. Gopuff, which raised a whopping $3.4 billion since founding, has been on the IPO rumor mill for some time, with the company hinting that it’s looking to crack profitability before opening up to the public markets. Estonian TNC / 3PD Bolt is targeting 2025 for its listing, having raised a modest $2 billion. Indian mobility giant Ola looks to be prepping for a public listing next year. On demand transit provider Via actually first filed to go public back in late ‘21, but was stymied by the turn in the market; it’s a similar story for scooter sharer Voi. I’m sure their investors are eagerly awaiting the market’s thaw.

What About Carsharing?

Readers who know me well may be thinking of one other mobility IPO that’s been parked for some time — Turo. Back at the turn of the previous decade, I was part of the tiny crew of weirdos naive enough to think we could convince Bostonians that yes, you should share your dusty old Prius with a neighbor. Patenting and launching peer-to-peer carsharing was how I cut my teeth in the mobility world, and while the company’s since moved on to focus less on urban mobility and more on destination travel, I obviously still have a soft spot for it. That said, I think I can read through its recent financial reports rather objectively…

The company filed its first S-1 back in January 2022. By the end of that year, the company had done $746.6 million in revenue and did something pretty rare for the mobility industry: it turned a profit — $154.7 million of net income and $33.8 million of operating income. But timing is everything, and a choppy market meant even that impressive financial achievement likely wasn’t enough to go public. The company’s dutifully been amending its filing every quarter, and as far as I can tell, nobody’s yet dived into the one it just filed for Q3 ‘23.

For the first nine months of the year, revenue grew to $665.6 million, up 19% from the year prior. Last year the company achieved 74.9% of its annual revenue in the first three quarters (so much for seasonality,) meaning we can expect this year to come in at about $888.5 million.

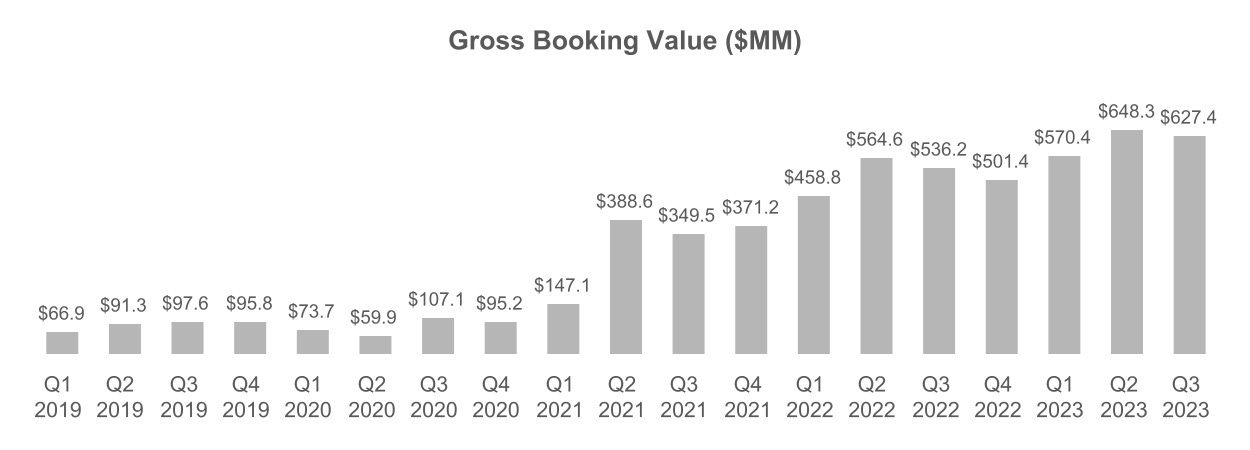

For those of you not well versed in marketplaces, a company doesn’t count the cash it merely passes on to its supply-side users; that’s called gross booking value. For the first nine months of 2023, Turo’s hit $1.846 billion, up 18% compared to the prior year, likely to end the year at $2.44B. I do think those numbers are a bit conservative, as the company just announced it completed its integration of France’s OuiCar, meaning it’s likely to his the gas *nyuk nyuk* on growing that market.

One open question is what’s the best comp for this startup. You could look at Hertz, which has done $7.19 billion in sales over the past nine months and conclude that Turo is now doing about 1/4 the volume of a 105 year old company.

Compared to other public marketplaces’ revenues, there’s still some catching up to do: Instacart’s done $2.2B in rev over the past 3 quarters, while Airbnb has made $7.7B and Uber’s reeled in a whopping $27.3 billion.

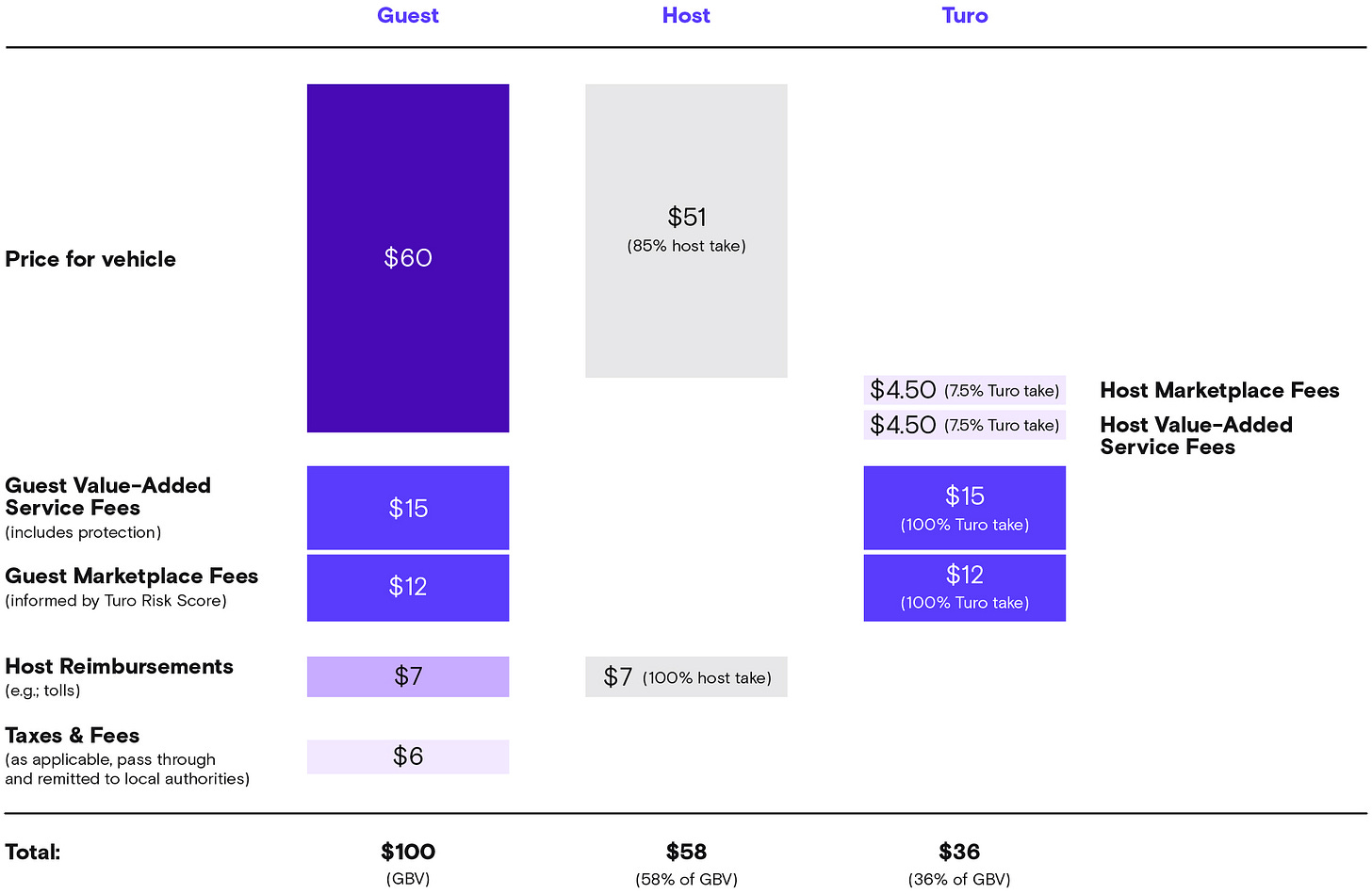

One place where p2p carsharing looks different than other marketplaces is in terms of take rate, which is revenue divided by GBV. Turo’s is 36%, while Airbnb’s is 18.6%, Uber’s is 27.8% for mobility and 20.5% for delivery; last quarter Instacart’s was only 10.2%.

I think that speaks to the concept staying closer to our original vision than some may suspect. Much of what Uber and Instacart are monetizing is gig worker’s time (with Instacart especially constrained by how easy it is to go shop for yourself.) While Airbnb’s monetizing an asset, people listing their primary residence need their cut to be good enough to make it worth putting up with a stranger or staying somewhere else themselves for a few days; for second homes, there’s margin pressure from competition by VRBO and traditional home rental services.

But with cars, just as we were saying way back in 2010, those assets sit unused 95% of the time. And given that the average car loan is only 5 to 6 years, even a relatively mint-looking listing may be fully paid off. In that sense, there’s way more upside for those listing their vehicles, which makes it a bit easier for Turo to capture some of that surplus.

Of course, back when we were swapping keys and RFIDs at community farmers markets on the mean streets of Cambridge, we thought that by increasing access to other people’s cars, more people would opt to not own a car themselves. The jury’s sadly still out on that one…

Calling all speakers – who do you think is at the forefront of mobility, transportation, curb management, restaurant / retail tech, delivery or civic policy? Nominate someone to speak at Curbivore 2024. Think big people, we want to hear your most interesting ideas!

HOT INDUSTRY NEWS & GOSSIP

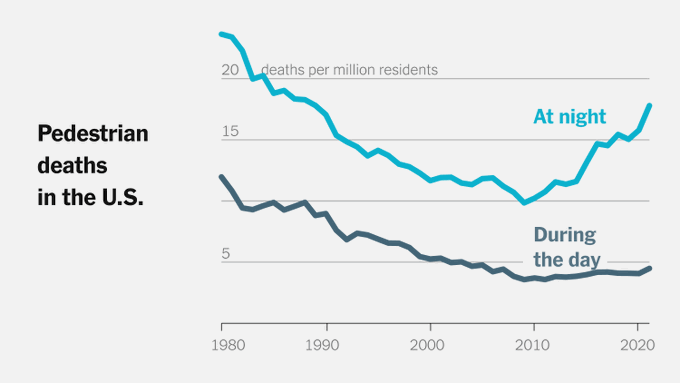

Two big NYT transportation pieces this week: The gray lady really had treats for the mobility world this week, with an illuminating piece on how the U.S.’ rise in pedestrian fatalities has largely occured at night. Possible culprits are the fact that America’s headlight standards are out of date compared to Europe’s, and a surge in population in the sunbelt means more people are living by roads with no sidewalks or overhead lights. Story number two was joyfully interactive, but felt like a breaking news report from a decade ago: bus rapid transit — it’s pretty good! Of course as often happens when looking past 8th Ave, mistakes were made. The BRT system that this article mostly celebrates for its low cost, located in Virginia, is a stinker (maybe that’s not the official term the ITDP used) compared to international systems: only about 1/3 is separated from car traffic and headways often slip to 15 or even 30 minutes.

Al fresco to the rescue: A new study on LA’s outdoor dining program proves that not only was it good for restaurateurs, it was great for city coffers. Participating restaurants did about $12 million more in sales per year; given that sales tax in LA is 9.5%, the gov’s cut more than offsets the $211k in lost meter revenue. And here’s a fun fact for you curb lovers — 45% of outdoor dining occured on the sidewalk, 52% on off-street parking lots, and 3% on curbside / on-street parking.

Sweetgreen turns on the machines: Salad slanger Sweetgreen debuted its second robot-powered location, in Orange County. As more lunches get delivered, watching the worker prep your greens becomes less and less important. But will a delivery bot handle the last mile?

The mean streets of Helsinki: Our friends at Drover have just finished a study of micromobility user behavior in the Finnish capital. This may prove once and for all that Finns aren’t Scandinavians: an insufficient bike lane network causes them to ride on sidewalks. While building better infrastructure will help in the long term, the study also found that the use of AI / computer vision monitoring improved rider compliance 15%.

Looking to party for a cause? Join our friends at Streets For All this Saturday, as they’re hosting their annual holiday bash. Your money goes to advocate for better streets and transit, while you get to meet some cool people. Win win!

Look ma, I’m on the teevee! I don’t need to convince you readers why most of Elon’s ideas are problematic, but Fox News viewers may be less familiar. I don’t think that Hyperloop is arriving any time soon…

No longer just a pipedream: Pipedream Labs officially launched the first phase of its underground delivery network in Peach Tree Corners, a tech-focused suburb of Atlanta. Pipedream’s taking deliveries underground, where its autonomous robots can avoid traffic and double parking; the current system is 0.7 miles long and connects the Curiosity Lab office park with a shopping center that would otherwise require traversing a busy highway. Think of it as delivery bots meet pneumatic tubes — restaurant and retail partners can load their goods into the machines, which then bring it back to hungry office workers on the other side. You may recall Justin Robinson, the company’s VP of Strategy & Partnerships, discussing their innovations at Curbivore ‘23.

Lime plays the long game: Lime VP Andrew Savage spills some interesting tea in this Zag Daily piece. Gross bookings rose 45% to $250M in H1, which likely puts the micromobility player on the cusp of profitability. Customers can also look forward to shared electric cargo trikes joining the network, thanks to Coaster Cycles.

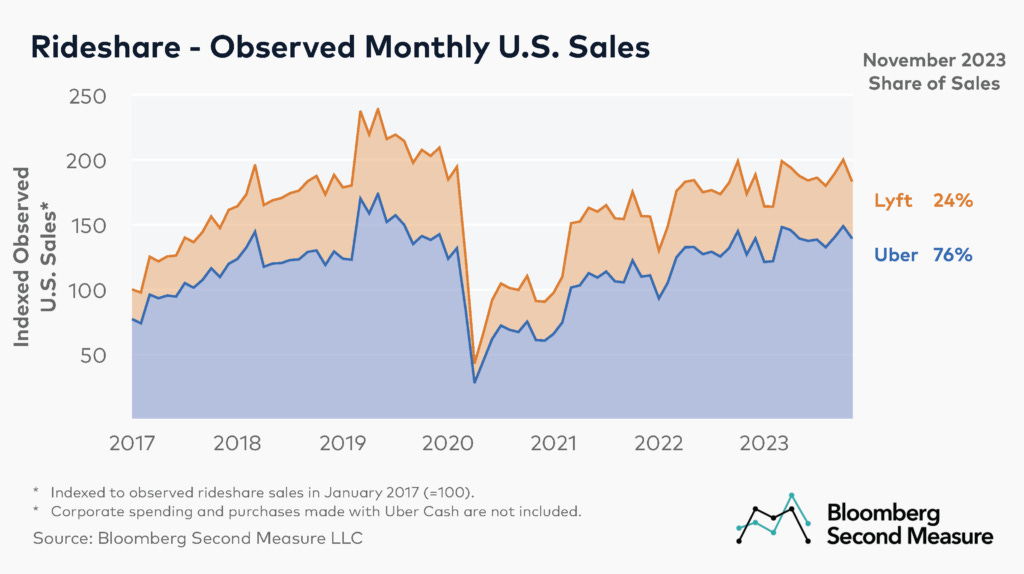

Rideshare market share: Lyft’s still struggling to catch up with Uber, as the two domestic rideshare leaders came in at 24% and 76% respectively. That’s a two point gain for Uber month over month.

A few good links: CloudKitchenes turns to automation as its ghost kitchens sit idle. COP28 concludes with a meke promise of “transition” away from fossil fuels. Delivery bot startup Delivers.AI partners with Deliverect. Pew survey shows broad support for more housing, less parking. LAX reno brings way more curb space to everyone’s favorite airport. An audio version of last week’s writeup on Rodeo, how flattering! Teamsters and UPS duel. Cruise axes execs. Vammo raises $30M to be the Gogoro of LatAm. NYC looks to fast track more housing. Congrats to Abundant Housing LA on selecting an amazing new Exec. Director. Europe puts legal pressure on the gig work model. How gov’t agencies can support the electrification of private fleet vehicles. Zigging where others zag, Faction’s CEO explains why his driverless delivery is built lean.

Got your Curbivore ticket yet?

- Jonah Bliss & The Curbivore Crew