Where Are Americans Moving?

And why pedestrians thought they could "buy something from the robot"

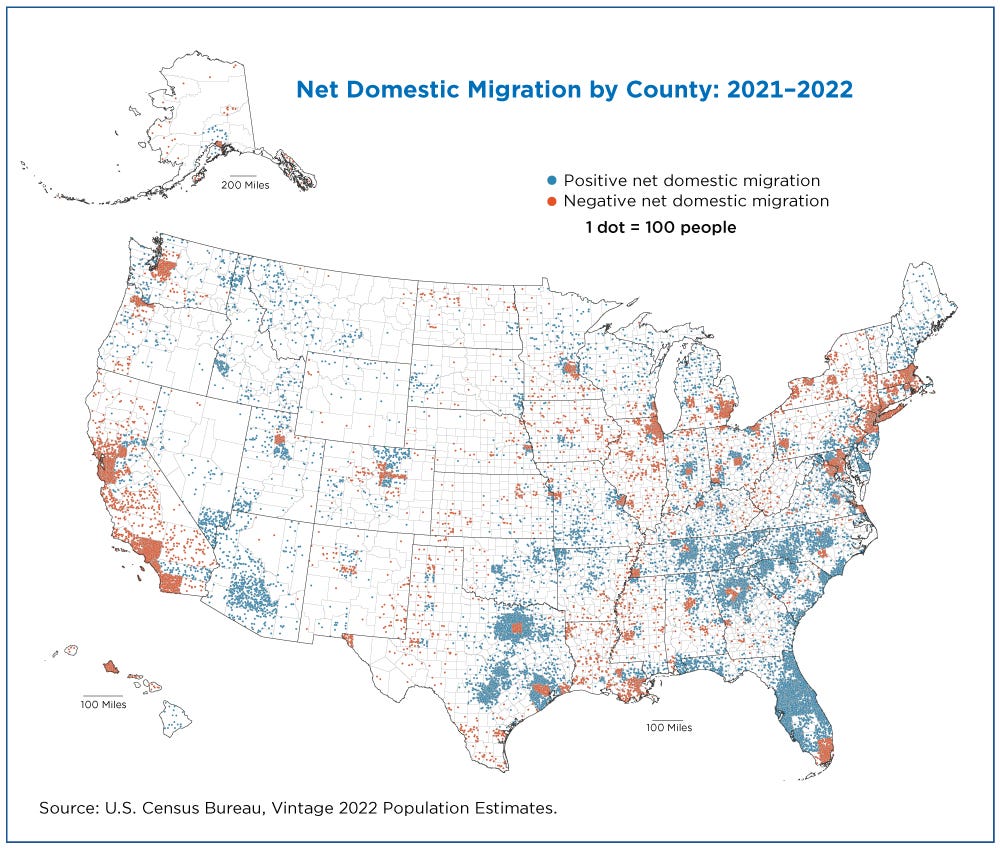

The message is dire: Americans are moving to places where they’ll live shorter lives, have lower earning potential, and spew more carbon. Okay, maybe that’s now how the Census Bureau framed the release of 2022 data, but that’s the unfortunate implication. While American metropoles and urbanized counties have slowed their declines from the height of the pandemic, big cities are still bleeding population.

Even from the space station view offered by this map, it’s clear that certain popular narratives aren’t true. Evidently not everyone “moved to Miami.” And Texas’ primary counties fared poorly as well. If there’s a snappy summation possible, it’s that by and large folks relocated to the suburbs, except that in the largest cities they moved even further: to the exurbs. (That is if they moved at all, keep in mind that the vast majority of Americans stayed put.) In fact: the fastest growing county in 2022 wasn’t deep in the heart of the South, but was actually Whitman County, Washington. Seemingly a land of contradictions, that county grew about 10% (to 47,619) after declining in the first year of the pandemic; its economy is a mix of agriculture and manufacturing; the politics lean center-left; and it’s about an hour drive to Spokane if you want any “big city amenities.”

But enough about that outlier, let’s take a look at some of the constituent counties that make up America’s primary metro areas. For ease of comparison, this next round of data will also include international migration and “vital events” (generally births slightly outweighing deaths) so we’re actually discussing overall population change, not just that caused by domestic migration. Starting in the Northwest, breaking things down by county names:

Greater Seattle:

King (Seattle): +0.6%

Pierce (Tacoma): No significant change

Snohomish (Suburbs): +0.5%

Looks like the tech economy in Seattle, plus strong housing growth for an American urban area, drew folks back to the city; less so in blue-collar Tacoma.

NorCal:

San Francisco: -0.3%

Alameda (Oakland): -0.9%

San Mateo (Silicon Valley / peninsula): -1.3%

Santa Clara (San Jose): -0.8%

Sacramento: -0.2%

Mendocino (Wine Country): -1.3%

Despite all the narrative about SF’s “struggles,” it sure looks like the core city outclassed its more suburban neighbors.

SoCal:

Los Angeles: -0.9%

Orange: -0.3%

San Bernardino (Inland Empire): No significant change

Riverside (Inland Empire): +0.8%

Santa Barbara: +1.5%

San Diego: No significant change

Interesting that one half of the Inland Empire stalled after growing last year, while Riverside still surged by over 20k (remember, CA counties are generally huge.) And if you’re someone that could afford to move to Santa Barbara, do you want to sponsor our next happy hour? ;)

Southwest:

Clark (Las Vegas): +1.2%

Maricopa (Phoenix): +1.3%

Pinal (Phoenix exurbs): +3.6%

Denver: +0.3%

Jefferson (Denver western ‘burbs): -0.8%

I hope you all like running your air conditioner! (Except you Colorodans - good work…)

Texas:

Travis (Austin): +1.4%

Williamson (Austin northern suburbs): +4.2%

Dallas: +0.5%

Tarrant (Fort Worth): +1.2%

Collin (Plano and northeastern DFW ‘burbs): +4.0%

Denton (northern DFW ‘burbs): +3.5%

Harris (Houston): +1.0%

Montgomery (northern ritzy Houston ‘burbs): +4.3%

Galveston (southeastern swampy Houston ‘burbs): +0.5%

Interestingly, Dallas and Houston proper both shrink when you look at just domestic migration, perhaps as locals chase job sprawl out to both cities’ northern plains. Austin’s primary county showed respectable growth, but unfortunately much of that is still wild land being turned into transit-less cul-de-sacs, while the core city gets carved up for new freeways (ahh, an American story as old as time!)

Chicago & Midwest:

Cook (Chicago): -1.3%

DuPage (western suburbs): -0.6%

DeKalb (western exurbs): -0.2%

Marion (Indianapolis): -0.2%

Wayne (Detroit): -0.9%

Cuyahoga (Cleveland): -0.9%

:(

Boston:

Suffolk (Boston): -0.7%

Middlesex (Cambridge, Somerville & northwestern ‘burbs): no significant change

Norfolk (Brookline and southwestern ‘burbs): +0.1%

The simple solution is that Harvard and MIT both need to increase their enrollment caps to about 100,000 students apiece. Massachusetts greatness is possible!

NYC / Tri-State:

New York (Manhattan): +1.1%

Kings (Brooklyn): -1.8%

Queens: -2.2%

Bronx: -2.9%

Richmond (Staten Island): -0.5%

Westchester (northern ‘burbs): -0.9%

Nassau (inner Long Island): -0.5%

Suffolk (outer Long Island): -0.5%

Ulster (“Catskills” exurbia): -0.8%

Western Connecticut Planning Region (CT is weird): -0.1%

Hudson, NJ (the “sixth borough”): no significant change

Bergen, NJ (the other “sixth borough”): -0.2%

Essex, NJ (Newark): -1.5%

Ocean, NJ (beachy exurbs): +0.9%

It’s encouraging to see Manhattan bounce back a bit, after losing 7% of its population in the first year of the pandemic. Not surprisingly, woodsy towns a few hours north (Ulster county, for example) lost population, after gaining folks the prior year. Perhaps city slickers realized that playing country wasn’t as much fun as they initially thought? The more interesting data to parse is why NJ outperformed NY State so much - a comparison that holds up across both its urban and more suburban regions. Property taxes are generally higher in the Garden State, so we can lay that conservative canard to rest. Towns along New Jersey Transit train lines tend to be a bit denser and more diverse than their counterparts across the river, so perhaps we can chock up a mild win for urban suburbanism?

D.C.:

District of Columbia: +0.5%

Arlington, VA (basically more DC): +0.2

Fairfax, VA (defense contractor suburbia): -0.3%

Loudoun, VA (exurbia): +0.9%

Montgomery, MD (‘burbs): -0.3%

Prince George’s, MD (‘burbs): -1.0%

Jefferson, WV (holy hell hyper exurbia): +0.8%

On one hand it’s encouraging to see DC proper bounce back after a tough prior year, especially as it outperforms the inner suburbs. But seeing Jefferson County, West Virginia boom means service on MARC better improve if there’s any hope of getting those people out of two hour long car commutes.)

Atlanta:

Fulton (Atlanta): +1.1%

Dekalb (eastern suburbs): +0.5%

Clayton (southern suburbs): -0.3%

Cobb (western ‘burbs): +0.7%

Gwinnett (northeastern ‘burbs): +1.1%

Cherokee (northern exurbs): +2.3%

It’s sadly not surprising to see Atlanta’s growth story diverge along racial fault lines. But hopefully rebounding population in the city proper will dampen enthusiasm for troubling local ideas that never seem to truly die down - like secession by the city’s wealthier northern neighborhoods.

Miami:

Miami-Dade: +0.1%

Broward (Ft. Lauderdale): +0.6%

Palm Beach (Mar-a-Lago): +1.0%

While the state as a whole grew a whopping 1.9%, the growth story doesn’t hold up in the more urban areas. Florida’s older population and weak Covid response means that overall deaths outstripped births, so Miami-Dade only managed to tread water thanks to international immigration outperforming the 38,000+ folks that left the city for other parts of the country.

Of course, parsing numbers is simple. The real question is - what do we do with this data? How can the curb-curious help restore growth to more urban parts of the country, and how can both the public and private sectors work to create healthy cities and businesses on the parts of the map where Americans have already made up their minds to move to. (Because I don’t think plopping a parklet in the middle of a 10-lane suburban stroad and calling it a day will do…) Tune in next week and we’ll have some answers ready! ✏️

HOT INDUSTRY NEWS & GOSSIP

Lessons learned on scooters, delivery bots, and mobile vending: Over at OttOmate News, I had a very in-depth conversation with Tortoise’s Co-Founder Dmitry Shevelenko. We touch on a number of macro factors affecting the curb economy - the fundraising environment, how to partner with giants like Walmart, teleoperations vs full autonomy, why pedestrians thought they could buy something from robots - with his expertise informed by previous stints at the likes of Uber, Facebook, Superpedestrian and Time. Well worth a read if you’re curious about the fate of so many other startups in this sector (normally pay-walled, but here’s a full access link.)

Happy 10th birthday, Citi Bike! America’s biggest bikeshare system turns 10, overcoming NIMBY opposition to become a treasured part of NYC’s modal mix. (Although despite JSK’s well-deserved pride in the system, we should note ridership pales in comparison to peer networks in Europe and Asia.) Part of that paucity of pedaling can be explained by the lack of public funding for the system, which means that longer rides can be quite expensive, and stations are lacking in lower income neighborhoods. With the system’s operator Lyft facing other financial struggles, Curbed’s Alyssa Walker wonders if riders will soon be in for a rude awakening…

Uber meets Amazon meets Rivian meets new fees… Uber looks like it might be facing off with the Everything Store, as its new prescription delivery service is set to debut. Will consumers get their drugs dropped off by Ubers, or will they turn to Amazon’s competitive service RxPass? Powering Amazon’s prescription predictions is its expanded fleet of Rivians, which now numbers 3,000 electric vans. Another ex-Amazonian (and ex-Instacarter) has his hands full, as Walmart CRO Seth Dallaire looks to beef up the retailer’s delivery offerings, as promised at this week’s “investor day.” And it looks like Minnesota wants a cut of that bonanza, as the state proposed new fees on ridehailing and delivery services.

Dynamic meter pricing heads east! Shoupistas rejoice - Arlington, VA is set to launch a performance parking pilot across 4,500 parking spots. This means meter rates will respond to demand, as previously seen in systems like SFPark and LA Express Park. Research from 2015 proves that these systems can ensure more meters are available at a slightly lower average rate, while still racking up minor increases in revenue to the operator. It’s honestly wild these systems have been so slow to take off - I remember contemplating how SFPark might impact our roll-out of RelayRides / Turo back in SF back in 2011. (It ended up being a non-issue…)

Paris says “non” to scooters: You’ve already seen the headlines, but the City of Lights voted to say adieu to scooters. Read between the lines and you’ll see that voter turnout was sub-10%, due to a lack of voting stations. The other interesting thing is that this was really more of a non-binding referendum, serving mostly to give Mayor Hidalgo the political cover she needs to do something she seemed to make her mind up about many months ago. I’ve teased that the city should really ban cars, but that idea isn’t looking so far fetched… over in Amsterdam they just launched a new set of vehicular restrictions. Oh and in other scooter news: Helbiz made a play for an odd rebranding that didn’t seem to improve its stock price but did piss off a lot of industry heavyweights.

But what can American cities do about dangerous drivers? Don’t expect ambitious changes to American roadways, but there are a few new technology options that might help us keep the most reckless of drivers off our streets. Police officers aren’t enforcing traffic laws (partially out of good natured reforms to minimize encounters, partially out of protest about said reforms) as verified by this new data from Seattle. So, will cities and states have the political will to ramp up camera and sensor based enforcement?

People problems! NYC’s Deliveristas labor group has won some impressive reforms for the city’s delivery workers, but now it appears to be beset by infighting, as the group struggles to handle blows from the Adams administration. Elsewhere in Big Apple legal loophole land - restaurants are installing “reverse ATMs” in a bid to get around city requirements that they accept cash for orders.

A classification conundrum: A Grubhub delivery driver in California won $65.11 after a court ruled he was a misclassified employee, not an independent contractor. That’s a small amount (related to owed overtime and minimum wages) but if the ruling holds it’ll have enormous implications for TNCs and delivery apps.

Will this be the last writeup of last month’s conference? We’re impressed to see news coverage of Curbivore ‘23 still trickling in! Over at GovTech, Skip Descant analyzes what our speakers had to say about getting workers out of cars and onto sustainable modes. And check out this amazing new Curbivore-born partnership between our friends at the OMF and itselectric.

In case you want more links… Chipotle and Sweetgreen brawl over bowls. DoorDash and Cookin heat up the home chef delivery market. Chick-fil-A hits the gas on its drive-thru game. Don’t get tee’d off - VW says no more gas powered Golfs. And Waymo waves goodbye to minivans. Starship cruises 10 million kilometers (of autonomous deliveries.) On demand electric pedicabs? Boxed folds. On the perils of well-intentioned development restrictions. Tech cutbacks actually pretty mild. Instacart delivers a bigger valuation for itself. LADOT wants your help to code the curb. Olo teases new loyalty product. LMD market to hit $721 billion by 2025!

Until next week…

- Jonah Bliss & The Curbivore Crew