Vegas vendors, Tokyo towers, Amazon's (de) acquisitions

Plus, is delivery finally profitable?

We’re keeping this week’s edition short and sweet, as yours truly is still recovering from finally getting a taste of this summer’s “air travel hell.” What should have been an easy Monday flight from Newark to LA became a multi-day affair after a last-minute cancellation, with JetBlue deciding a Wednesday evening connection in Orlando was just a can’t-miss opportunity. Anyone else remember when they were “the good airline”? Anyway, the point isn’t to kvetch too long, but to point out that as usual, Biden and Buttigieg are on it! New rules have been in the works for some time, which require airlines to compensate passengers for cancellations and severe delays. Remember: elections matter!

HOT INDUSTRY NEWS & GOSSIP

Serving up a public listing: Fresh off a recent bout of crowdfunding, delivery robotics pioneer Serve raised a fresh $30M, and is set to hit the public markets via a reverse merger (but not, we should note, a SPAC.) We’ve seen some other players in this space get creative with capitalization (Kiwibot’s asset-based financing comes to mind,) but this is certainly the first delivery bot company to head towards a public listing. Will key backers, which include Uber and NVIDIA, hold on for the long haul?

Moove-ing up! Speaking of fundraising, African automotive fintech startup Moove just raised a fresh $76M, in a mix of equity and venture debt. As many local consumers have limited credit history, this platform is instead largely aimed towards ridehail drivers and delivery couriers, essentially providing the vehicle financing that lets an Uber or Glovo gig worker get the vehicle they need for work.

Profitability delivered: Fresh off of Uber’s big announcement that it’s running in the black, food delivery giant Delivery Hero had a similar celebration of its own: it achieved its first profitable half-year in corporate history. The parent company might not be a household name stateside, but it has subsidiaries the world over: Foodora in Europe, Talabat and HungerStation in the Middle East, foodpanda in Asia, Glovo in Africa, PedidosYa in LatAm, and many more. Worth noting is that Dmarts — its quick commerce division — achieved profitability as well.

Lyft’s less lucky: Rounding out earning season, Lyft initially pleased the market when it announced it had trimmed losses in Q2, with revenue inching up to $1.021 billion. But when CEO David Risher announced the company was planning to end primetime (its branded version of surge pricing,) shares fell as investors predict the Pink Moustache will have a tough time tickling its way towards breakeven.

Viva Las Vendors! Enough financial news, on to something for the people: Nevada is set to update its street vending rules. Senate Bill 92 goes into effect in October, and lets vendors work in neighborhoods legally, although certain municipalities, like Las Vegas, can add time and zone based restrictions. Who else is up for elote on The Strip?

Electric deliveries in Mexico: GM’s EV subsidiary BrightDrop is headed to Mexico, where its Zevo 400 and 600 vans will be available by year’s end. While EVs are still too expensive for the average Mexican consumer — they only made up 0.5% of all sales there last year — fleets can finance them and come out ahead in the long term with lower operating and maintenance costs.

A jungle brawl for Amazon: Amazon surprised the market with better than expected earnings in Q2, but investors are the least of its worries. The company has been meeting with FTC regulators, as the government weighs an antitrust suit against the ecommerce and delivery giant. It looks like Bezos might be breaking a small sweat — this morning the company announced it’s closing down a number of its first-party brands, including 27 of its 30 clothing lines. Our sincerest apologies to any Lark & Ro fans out there who have to process this devastating news.

Bus problems: Electric bus maker Proterra filed for bankruptcy reorganization, the latest mobility SPAC to trip on the curb. It’s a tough time out there for the bus industry, as Volvo’s Nova unit recently announced it will pull out of the American market, and BYD remains in limbo due to the National Defense Authorization Act. Maybe it’s time to scrap Buy American requirements on EV busses, for the good of the planet?

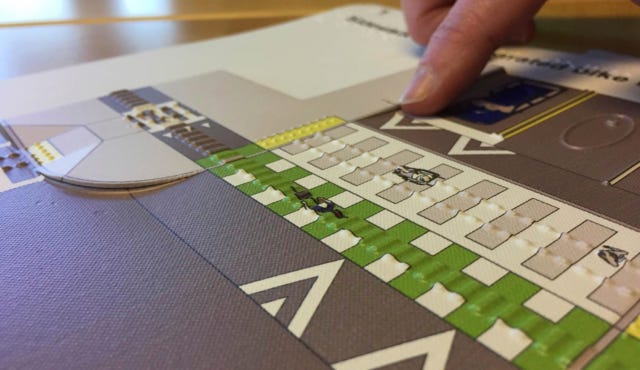

Something nice regarding the other kind of mobility! After 21 years in draft format, the U.S. Access Board published the Accessibility Guidelines for Pedestrian Facilities in the Public Right-of-Way, aka PROWAG. Set to be enforced by the DOT, this will make for new and improved guidelines on accessibility for those with mobility impairments. Expect to see changes to curb ramps, warning surfaces, crossung buttons, loading zones, street furniture and more.

Housing, housing, housing: BusinessWeek has a thoughtful piece about how the Minneapolis-St. Paul region is the first metro area to beat inflation, thanks largely to healthy home-building rates that have kept housing costs in check. Rent in the cold-weather city is only up 1% since 2017, even as the Twin Cities avoided the Covid exodus that plagued many other established areas. To put its housing growth in perspective, Minneapolis-St. Paul-Bloomington, MN-WI permitted 24,996 housing units in 2022, whereas Greater Chicago only permitted 17,360, despite Chicagoland being almost 3x as populous. While local zoning reform has made the region pretty friendly to apartments, the region still has plenty of room for single family homes: 63% of those units were in multifamily structures. Again for comparison, that rate tends to be about 67-80% in metro areas like SF, LA and NYC, and 37-43% in spots like Dallas and Houston.

Now for a real city: Of course nowhere in America can keep up with the city-building and inflation-taming theatrics of Tokyo, where the new Azubudai Hills project opens this November. This development, the latest in a string of megaprojects so named after both Beverly Hills and the hills west of the Imperial Palace, includes 150 retail outlets, 1,400 residential units, 214,500 square meters of office space, new roads, the country’s tallest building and access to multiple subway stations. Planning started in 1989, construction began in 2019. 😎

A few good links: Downtown real estate and transit ridership recoveries are intertwined. Q&A event next Thursday with Sprinkles’ Candace Nelson (remember her from Curbivore ‘23?) INRIX raises $70M. About time: NY lawmakers want to install speed limiters on serial speeding offenders’ vehicles. Tim Hortons introduces first “boat-through” restaurant in Ontario’s Lake Scugog. WeWork raises substantial doubt about its ability to stay in business. UPS full-time drivers will average $170k in pay and benefits at the end of their new five-year contract; if you’re jealous, don’t complain, join a union! Vancouver’s TransLink releases new report showing the benefits of bus lanes.

Until next week!

- Jonah Bliss & The Curbivore Crew