The Emerging Decline of the Downtown Desk Warrior Lunch?

Is Ford's new cheap electric SUV a good or bad idea?

All is not well in the land of the sad office lunch. After seemingly unstoppable growth, defying both the pandemic and the “new normal” that followed, America’s FCRs are in trouble.

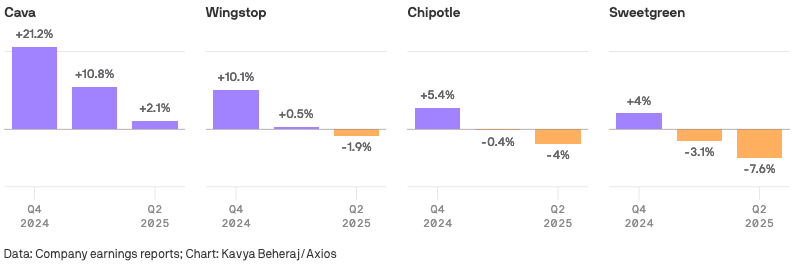

Whether you take your bowl with grains, beans, greens or just too much chicken… chains like Sweetgreen, Chipotle, CAVA and Wingstop all just posted disappointing Q2s, showing sales growth slowing or even reversing.

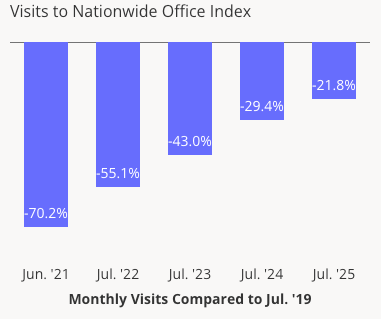

For a while, these chains managed to stay ahead of the curve… blossoming across the suburbs as American office workers decamped from the CBD post-Covid. But recently, the push to return workers to their offices, whether in towers or parks, has slowed: Placer.AI data shows the past 12 months had the most tepid progress of any timeframe post-pandemic.

Combined with “Greater pressure on lower income consumers,” and all of a sudden there are fewer folks in the mood for $17.95 spicy lamb + avocado bowls. And while these chains have made big plays into automating their makelines to bring down costs (in fact, Cava just announced it was joining Chipotle in investing into Hyphen), the background noise of rising automation, store closures and diminished labor power could be one of the leading factors keeping consumers’ wallets shuttered.

If these fast casual, delivery-optimized restaurants are the indicator species for the health of America’s business districts and office workers, H2 ‘25 could end up looking pretty rough indeed.

PARTNER | DoorDash vs. Uber Eats: The Flower Delivery Battle That Could Shape the Future of On-Demand’s Delivery

Mother’s Day. Valentine’s Day. These aren’t just big days for gifts — they’re a battleground for retail delivery dominance. For many customers, their first non-food delivery happens on a holiday. That first experience can shape loyalty for every delivery after.

The Gridwise Special Occasion Report unpacks how platform performance on key dates is revealing early leaders in the race for retail.

Mother’s Day demand exploded: Delivery volume spiked 1,174% above baseline in 2025, up from 723% in 2024.

Uber Eats surged on Valentine’s Day: Its market share jumped from 25% to 52% — more than doubling overnight.

DoorDash market share declined on Mother’s Day: Market share fell from 60% to 43%, marking a significant year-over-year drop.

🔗 Get the full report and see what these seasonal shifts mean for the future of delivery.

Toto… we’re not in Dearborn any more: Ford is investing $2 billion into its Louisville plant, using plans invented by its Long Beach, CA skunkworks team to throw out its classic manufacturing process, hoping that this redo will allow it to make EVs for a modest $30k. Naturally, the first vehicle expected off the line is a mid-size pickup. On one hand, it’s lovely to see an American OEM not sticking its head in the sand and instead choosing to invest in continued electrification, as opposed to doubling down on gas guzzlers and forever ceding the worldwide market to more nimble international competitors. But… if the outcome of all that innovation is just even more big ol’ trucks and SUVs, that’s not so great either. Here’s a crazy idea about how to make a cheaper EV: don’t make them so damn big!

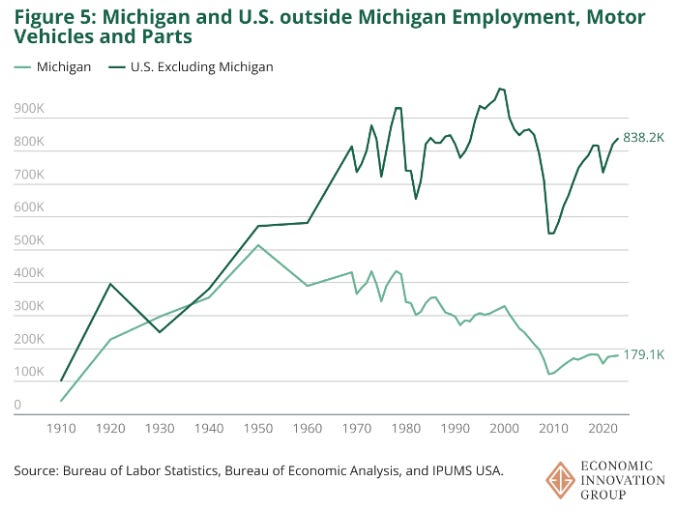

Thinking about automakers and American industrial policy… Many policy wonks cling to the idea that American auto-making and employment collapsed in the 1980s, done in by successive waves of imports. New EIG data shows that in actuality, the decline was wholly localized first to Detroit, then greater Michigan, while manufacturing took off in other states. Blame the open shop movement, I suppose?

On to public transit news, mostly bad! Pennsylvania lawmakers are nearly out of time to fund SEPTA, leading Philly’s transit agency to plan for drastic service cuts and fare hikes; damaging one of the nation’s premiere public transit networks would push an estimated extra 275K cars onto the roads. South Florida’s Tri-Rail also looks to be in trouble too, despite achieving record ridership. Honolulu’s begun construction of the third phase of its HART rail line, but budget constraints still mean it won’t serve popular Waikiki. Chicago plans to replace its ancient State/Lake Station with a lovely new stop designed by SOM (see below; not much exposure from the elements though, eh?) BART now lets riders tap in with their credit cards, no digital fare card required. NYC is mixing up plans for the IBX, removing all street-running segments in the name of improved speed. The FTA has signed off on Minneapolis’ Blue Line extension. And the MBTA is planning to expand service hours to run later in the evening (I remember a previous trial in 2014-16, it almost made Boston fun!)

Who’s hungry for competition? Indian ridehailing player Rapido is breaking into the hyper-competitive food delivery market, with the launch of Ownly. The company is starting in the tech capital of Bengaluru, where it will face entrenched competition from Swiggy and Zomato. Ownly hopes to win over customers and merchants with ultra low rates, like Rs10 ($0.11) in fees on orders of Rs100 ($1.14) or less. Talk about tough competition!

Music for your tin ears… Sometimes it’s the little things that make the difference, like Waymo finally improving the clunky music system in its AVs, thanks to a new partnership with Spotify. Meanwhile, Lyft plans to bring Baidu’s Apollo Go robotaxis to Europe, as it uses its recent acquisition of Freenow to play catch up in a big way.

Swap it like it’s hot! Getting polluting big rigs off urban roads is a tricky proposition; their huge energy requirements means that recharging electrified trucks can take a looong time. Now, Singapore is trialing a new system by EcoSwift that would swap battery packs out of depleted trucks, allowing for quicker turnarounds and cheaper infrastructure costs. Sounds nice, but maybe a bit trickier in places that aren’t islands with strong governance?

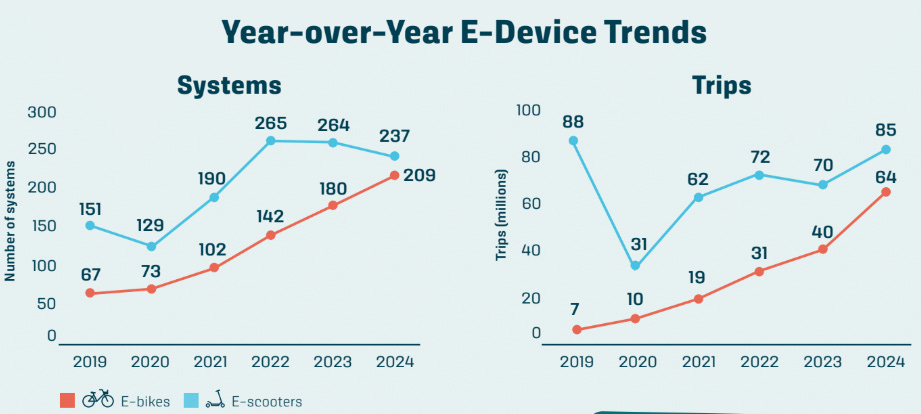

Micromobility, macro impact: Micromobility ridership in North America hit an all-time high in 2024, up 31% to 225 million rides. Gains were particularly strong in NYC and LA, and e-bikes are quickly catching up with scooters. Meanwhile, Denver has a great idea to solve first and last mile challenges near its transit stops: RTD is offering free scooter rides for trips to University of Denver and Decatur-Federal stations.

A few good links: Tesla eyes launch of “robotaxi” service in NYC. Road funding falls short in most states. Joby buys Blade in deal to accelerate take off of air taxi. Lucid cuts EV production targets. Rivian posts unexpectedly wide losses. A wonderfully American story: couple arrested after their child is killed by motorist. How calming: Cambridge, MA goes big on speed bumps. Shell powers down Volta ad-fueled charging biz. Denver nixes parking minimums. NYC looks to daylight more curbs, removing 300k parking spots in the process. GM scores domestic supply of rare earth magnets. Google pushes AI into flight search, amid increase in regulatory scrutiny. In possible warning for other marketplace and mobility providers, Airbnb expects tough second half of year. NYC looks to upzone part of Midtown, in push tie to finally completing 34th Street busway. GM and Hyundai to collaborate on five vehicles, including electric van. NEVI EV charging funding restored after court order, now with way fewer strings attached. New on-road driving Pinkbots hit the streets of Miami.

Please note — I’ll be publishing, and podcasting, on a reduced schedule for the next few weeks, as I take some time off over the summer. But you can still get your fix over at Modern Delivery!

- Jonah Bliss & The Curbivore Crew