Kick the Tires on a New E-bike Company’s Financials

Fly-E Group goes public, sustainable startup funding falters, transit ridership recovering

How often do you get to open the books on a six year old company? Meet Fly-E Group, an e-bike brand based out of NYC, that just went public on the Nasdaq. And while I generally think small cap companies going public early is a bit of a red flag, as whatever capital they raise is going to quickly get gobbled up by increased regulatory compliance and accounting costs, the company’s S-1 gives us a unique chance to examine the economics of the electric bike and moped space. (And please note, none of this is investment advice.)

Fly-E offers a litany of lightweight electrified vehicles — e-motorcycles, e-mopeds, e-bikes, even e-trikes — sourced from China with final assembly done domestically. While the company does some wholesaling and online sales, it moves most of its products through 39 stores across the U.S. and Canada. Over the past two years, the company’s produced 9,677 e-motorcycles, 13,636 e-bikes and 5,450 e-scooters. That bike arm of the biz is arguably its most important, with the company growing to be “one of the leading providers of e-bikes for food delivery workers in New York City.”

That’s a very price sensitive market, meaning that Fly-E isn’t exactly making high-end, carbon fiber beauties; their average sales price was just $941 in 2923, up from $644 for the year prior, thanks largely to their sales mix moving towards more of their pricier e-motorcycles. Calling around to a few of their stores, I was told over the phone that their cheapest e-bike for a “used, small” model was about $600, better than the online prices for pre-owned models from other price-conscious brands like Rad Power and Aventon. And despite all their overhead, they manage to eke out a respectable profit, with an EBIT margin of 11.2%, thanks to just how cheap e-bike components have become. (It’s amazing how much COGS have plummeted since I scaled up EVELO over a decade ago.)

The company keeps itself lean in other ways, spending just $3 million on payroll despite employing 57 FTEs and 27 part timers. Fly-E may be working to build an app for its bikes, but this is clearly a company that’s made its numbers work by thinking like a local mom and pop retailer, not a high-flying tech startup. Even the executive team seems to live by that ethos, with Founder & CEO Zhou Ou taking home just $100k per year.

While it’s a whole lot “sexier” to build an “iPhone for ebikes,” we’ve seen time and time again just how difficult a route that is. VanMoof went bankrupt and even with a new owner it has no plans to make customers whole; money-burning Cowboy is actually seeing its revenue fall, not grow. Evidently the key to success in the e-bike biz is making an affordable product that gets people (especially couriers) from A to B, with no time for distractions in between.

HOT INDUSTRY NEWS & GOSSIP

Itselectric charges up: Let’s kick this section off with some fundraising news… congrats to our friends at Itselectric for a well-earned $6.5 million in seed funding, led by Failup Ventures and Uber Technologies, with participation from Halogen Ventures, The Partnership Fund for NYC, Pulse Fund, Newlab, Gratitude Railroad, Tale VP, Equity Alliance Fund, LACI Impact Fund and The Helm. It’s great to see curbside charging take its rightful place in the pantheon of pro-city solutions that occupy a lil slice of the curb, and it’s amazing how far this company has come since I first met co-founders Tiya and Nathan in October 2022. Also interesting to see Uber make a seed investment, a rare move for the TNC giant as it hunts for ways to electrify its own fleet.

Hayden AI eyes $90M: On to even bigger checks, as SF-based Hayden AI just scored a whopping $90 million in a Series C led by TPG’s Rise Fund. Hayden’s AI-powered camera tech works to keep bus lanes free from scofflaw motorists, and this fresh funding means we’re likely to see it come to more and more cities nationwide. (On that note, Hayden AI just signed a deal with Long Beach Transit.)

More money for chargers: Another company leading the electrification charge scored some important funding, with ChargerHelp! securing financial support from the State of California to build a training hub in South LA, aimed at training more charging techs to help quickly fix up wonky chargers for the likes of Shell Recharge, Tritium and Rivian.

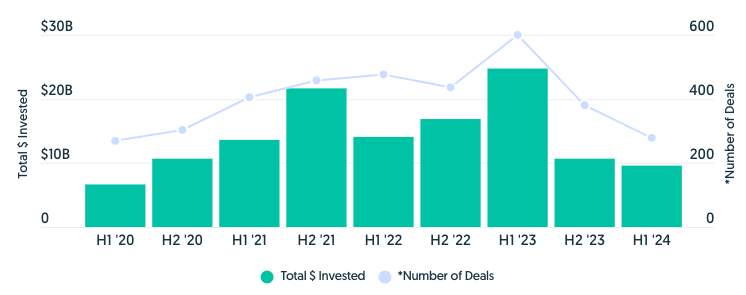

Now on to the less good news… Evidently not every cleantech startup has been so successful at fundraising the last few quarters, with Crunchbase noting that funding in the sustainability, EV and cleantech categories fell to $9.6 billion in H1 ‘24, down a smidge from the previous half year, but waaaay down form H1 ‘23’s record $24.7 billion haul.

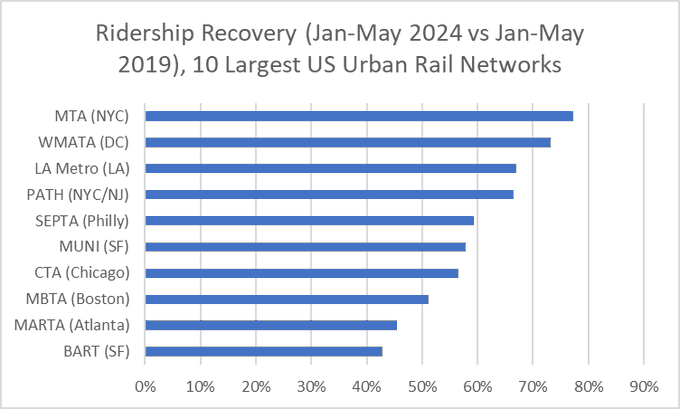

Now for some bar charts going horizontally! Looking at FTA data, one can really see how much the rail ridership recovery has varied city by city. Apacitas Economics highlights that NYC, DC and LA have seen about 70% of their riders return, while cities like SF, Boston, Atlanta and Chicago are stuck around 50%, due to a combination of reduced service and more downtown workers staying remote. For smaller networks, San Diego and Seattle have actually exceeded their 2019 ridership comps, thanks to well-located system expansions. The rankings look pretty similar for bus operators as well, with DC, Jersey, NYC, Houston and LA leading the pack.

Dining dead? Outdoor dining in NYC has gone through quite a saga, first blossoming after covid, then engendering a NIMBY backlash, with the city in turn writing up tighter restrictions while at the same time trying to make it a bit easier by giving restaurateurs access to a “kit of parts” for their approved build outs. But it looks like the tighter rules are really dampening dining options, with only 23 restaurants having scheduled public hearings to move from the temporary to permanent program for on-roadway seating, with under three weeks to go before the deadline. At least New Yorkers will have somewhere to park their precious cars! ;)

Maybe it’s not just interest rates… Urban housing production has plummeted in major cities nationwide, with the tighter credit market receiving much of the blame. Yet San Diego has managed to approve the most new homes since the 1980s, as a raft of pro-housing laws buoys both market-rate and rent-restricted development. SD approved 70 homes per 10,000 residents, beating LA’s 49 per 10k and SF’s 38 per 10k. There’s more work to be done though, as the city is still behind the pace necessary to hit its state housing goals, and those aforementioned interest rates mean that not every approved unit will actually get built. Oh and here’s another thing California can due to help unleash more naturally affordable housing construction: reform the state’s broken defect liability laws, which hamper condo building.

Cheap rail for small cities? It’ll be interesting to see if this proposal goes anywhere… Johnson County, Iowa (population 152,000) is looking to add passenger service to a lightly used freight line, connecting the University of Iowa and Iowa City. County Supervisors hope to work with RDC’s Pop-Up Metro program, which uses refurbished battery-powered trains and temporary boarding platforms to keep costs an order of magnitude lower than the usual expenditures necessary to get passenger rail going in this country.

A few good links: NYC Comptroller assembling team to sue state over stalled congestion pricing program. Port of LA expands rail tracks 31,000 linear feet (~5.9 miles) for $73 million — why can’t we build light rail for that anywhere near that price? Construction project abandonments on the rise. House GOP looks for new ways to gut transportation regulations post Chevron reversal. Helixx wants to build $6K delivery vans. NYC courier pay up 56%. GEM sues EPA / IRS in hopes of getting LSVs to qualify for tax credits — a decent cause but I don’t love the idea of using the same tactics that killed the EPA’s Good Neighbor air pollution rule…

Until next week!

- Jonah Bliss & The Curbivore Crew

Great read!