Hurry Up and Wait – How to Make the Best of Charging Bottlenecks

Bergen vs Bergen, Bird buys Spin, street vendors in LA

Today’s insights are written by Laolu Adeola, Founder of Leke Services.

Not many people are still pessimistic enough to assume that EVs are a passing fad. Practically all the prominent EV adoption forecasts point to many more EVs in use by 2030 & beyond. The uncertainty that remains here, is which of the following scenarios will we end up with?

A. EV adoption continues to accelerate to meet emission targets,

B. Adoption accelerates and we exceed emission targets, or

C. Pace decreases, and we miss vehicle emission reduction targets

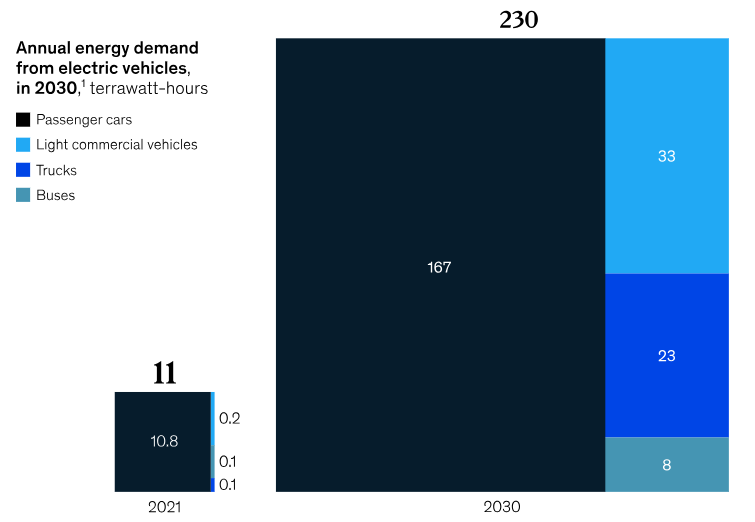

To make sure we don’t end up with the third scenario we need to consider the switch from refilling gas tanks to recharging batteries. There is plenty of skepticism about whether we’d be able to meet this demand due to a variety of factors, some of which we’ll go over. For this, the first question to address is, “How much charging capacity will we need?”. Thankfully, the folks over at McKinsey have taken a pass at figuring this out to estimate that by 2030, there will be a demand for 230 terawatt-hours of energy by EVs, compared to just 11 TWh in 2021.

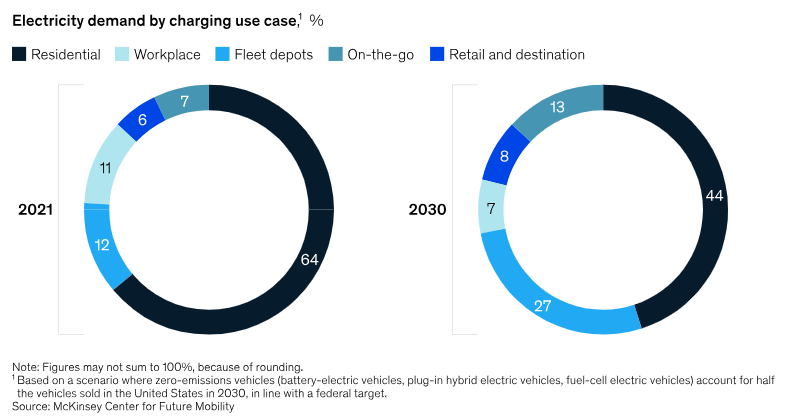

Considering that the vehicle charging industry barely existed 10 years ago, there has been a major boom. This brings us to the next question: “How will vehicle charging happen?”. To understand how vehicles may charge, we need to consider a lot of factors including range, battery capacity, trip type, use cycles, charger availability and weather. Considerations for each of these will vary by vehicle model to determine if the vehicle is charged at home, work, at a depot or ‘on the go’ (e.g., on a road trip.)

According to another report, 40% of charging demand in 2030 will come from fleet depots and 'on the go' categories. These facilities typically require access to large amounts of electricity, lots of capital, and at least 12-18 months of lead time in perfect circumstances.

The charging boom has produced scaled proof of concept success with the likes of Tesla's network which recently hit 50,000 superchargers. But now, as more players enter the mix, we need to answer the next question: “Can the supply meet the demand?” The short answer is, “not yet.” Some reasons include:

Long lead times on facility development: after an initial facility plan (this includes number of chargers, types of chargers, layout, safety, electric loads, etc.) is created, developers need to work closely with utility companies to ensure they can get power from the grid. Outside of this, they can explore off-grid solutions like solar. Regardless of the path forward, it takes a long time to get to the first charge at a site. Best in class execution has achieved this in 12 months, but increased demand and associated complexities (e.g., environmental studies) can mean up to five year lead times.

Critical hardware supply shortages: demand spikes for charging equipment (e.g., converters, switchgear, filters) have caused them to be in short supply. This is especially crucial for high voltage direct current (HVDC) components. They are necessary for charge times to come close to that of gas stations. There isn’t any manufacturing in the US, and according to the DOE, there were only 350 HVDC systems worldwide in 2022. Compare this to a projection showing we need 140,000 DC fast charge ports by 2030. Supply for lower voltage equipment also remains limited due to competing demand from other semiconductor applications which has been limited since the pandemic.

Rapidly evolving demand patterns: EV adoption is just now crossing over to the era of mass adoption. With this comes growing pains. For example, there are reports of auto dealers turning them down as customer demand starts to cool. It comes on the heels of remarkable growth in 2022 that led to expanded production from automakers who were barely able to keep up with demand. Early EV adopters were willing to put up with one of the dominant pain points in EV ownership is charging. Service providers need to maintain a certain level of flexibility in their plans to maintain proper asset utilization rates, but whatever changes they make may cause even more waiting.

For EV buyers, this makes the prospect of adoption more complicated. Most charging is done at home and projected to stay that way. But experiences at fast charge facilities will be hampered. No charger provider (except arguably Tesla) currently has a large enough network to reliably provide charging across the country. This means consumers are left adopting a hodgepodge approach – signing up for multiple services while not receiving a consistent charging experience.

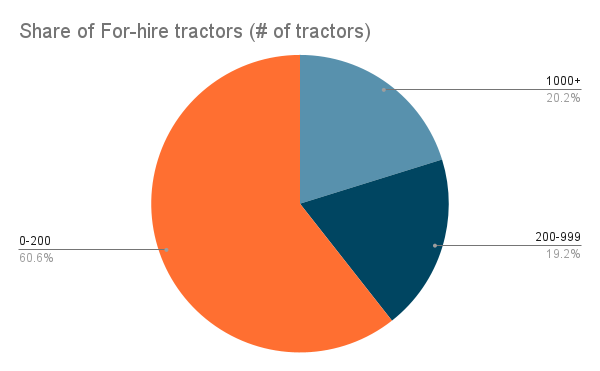

On the commercial side of things, the build out of charging corridors will be critical to achieving emissions objectives while maintaining profitable operations. We can break things down by fleet size using info from Freight Waves to differentiate demand types:

Large fleets (over 1,000 tractors) account for 19% of for hire trucks. These fleets are most likely to build private depots with DC charging. For example, FedEx, the largest of this group had installed over 500 charging stations as of last summer.

Mid-sized fleets (over 200 tractors) makeup another 20% of the group. They are unlikely to build dedicated charging depots, but may install some fast chargers at their key facilities. They will need to rely on predictable capacity from public chargers to sustain their operations.

Small fleets (less than 200 tractors) make up the remaining 60% of for hire trucks on the road. Nearly half of this highly fragmented sub-segment is made up of owner-operators who need to feel their way around different charging operations that work for them (e.g., public charging depots, Level 1 & 2 charging, etc.)

This brings us to the final question: “What now?” The best laid plans are at risk driven by fundamental economic factors of supply / demand, and accordingly, there are a few options to weather the storm, all of this will depend on the available financial runway and internal objectives.

Spend your way out of it – a lot of equipment suppliers offer options to skip places in the queue by paying for the privilege. This inevitably puts pressure on return on investment calculations. It could be justified with a strong customer acquisition narrative that prioritizes the gaining share as the industry grows larger and more fragmented

Coalitions – joining forces with competitors may help improve footprint by ensuring coverage along critical routes for customers in affiliated programs. This will give customers a reason to adopt your offerings while working through delays. However, it could lead to consolidation which may be seen as inevitable evolution.

Use the time wisely - a slower growth pace should allow for increased focus improving operational margins. Prioritize efforts that allow you to get great at delivering superior customer experiences, while reducing waste. This may mean creating a customized fleet management solution, or developing long term partnerships with large fleets (see announcement from Zeem and Hertz).

Like other disruptions, the transition to EVs is entering a critical period which could accelerate or stall the momentum. Charging infrastructure is on the critical path for widespread EVs adoption. Its future as a permanent curb fixture will require more than just deep pockets, but also some ingenuity and grit.

Laolu is the Principal and Founder of Leke Services. He partners with leaders of mobility companies to improve their performance margins. Check out his other perspectives.

HOT INDUSTRY NEWS & GOSSIP

An albatross or a second wind for Bird? One week after competitor Lime teased profitability, micromobility godfather Bird has some big news of its own: it’s acquiring erstwhile competitor Spin from Germany’s Tier for $19M. To make the financing work, Bird is paying $10M upfront (largely with cash borrowed from MidCap Financial that they secured by pledging basically all the company’s assets,) $6M in deferred payments at an 8% interest rate, and another $3M contingent in a holdback based on hitting benchmarks — to be paid in a split of cash and stock.

The deal is obviously risky for Bird, which is running low on cash and exiting markets; the entire transaction is worth more than Bird’s market cap. But perhaps it’s a hail mary that gives it one last shot at success; the deal briefly pushed its stock (BIRD 0.00%↑) price above the $1 delisting territory, it’s now sunk a bit to 91 cents. Bird not only secures new battery-swappable hardware, it lets the company re-enter some American markets it lost contracts to, and is likely to come with lots more headcount shedding.

For Tier, it buys the company a few more months of breathing room as they look for one of their European competitors to snap them up. For a bit of humbling context, when Spin was originally acquired by Ford way back in 2018, the automaker shelled out $100 million for the scooter co.

For a bit more insight, I caught up with Alex Nesic, co-founder of Drover, which supplies computer vision solutions for mobility providers (including Spin.) He said: "While Bird acquiring Spin was not on my bingo card for 2023, consolidation has been in the cards for some time and this particular pairing does make sense on many levels. Bird has recently had to become much more selective in its deployments and Spin has long been one of the best at winning highly competitive markets - even displacing Bird from their former home in Santa Monica thanks in part to Drover tech - so this move brings Bird back to the table in many coveted markets. The deal also appears to be a smart way for Bird to acquire newer vehicle types and add variety to their fleets with swappable batteries for markets that favor those… Now let’s see how things shake out in Europe!"

A bit more micromobility gossip: New data on Lime shows the micromobility player is eking out a small profit (€203.8k) in Belgium and derives at least 10% of its global revenue from Germany. Meanwhile, Helbiz looks to be pushing out more stock to stay afloat.

Smart curbs of the world unite: Smart Cities Dive has a good rundown on best practices learned from various curb management pilots. By enticing the community with a free initial 15-minutes, Pittsburgh has expanded from 20 to 200 zones. Santa Monica’s prioritization of zero emissions vehicles inadvertently led to it becoming a delivery bot hotspot. And of course fresh federal money is bringing new programs to cities like Miami and San Jose.

There’s always money in the map box: Mapbox went from being a stylish custom map provider meant to give you a jazzier Google Maps alternative, to a full-on navigation and location services platform embedded into automotive ADAS systems. That pivot, and big traction, just added up to a $280M series E led by Softbank.

Fresh federal cash: The EPA has opened applications for $4.6 billion in competitive grants for implementing climate action plans. Open to state, territorial and tribal governments, the money follows an earlier tranche meant for cities, and is targeting GHG reductions of 50-52% by 2030.

I’m (not) parkin’ here! NYC Mayor Adams has called for the elimination of parking minimum mandates on all new housing, a no-brainer in any city but particularly obvious in a transit-rich place like New York. Next up, Hizzoner will need to fight these weirdos who oppose the addition of garbage cans to their street, because they somehow see the festering bags of trash on the curb as more scenic.

To live and ride in LA: Waymo is finally putting some dates on the launch of its long-teased robotaxi service around Los Angeles. The pilot, which offers free rides, will run from 10/11 to 3/03 and jump between Santa Monica, Century City, Mid City, West Hollywood, Ktown and Downtown LA. On the public transit side, Metro is continuing to roll out new bus lanes, with improvements about to start on Sepulveda and Ventura in October, and other thoroughfares like Santa Monica and Vermont getting them in 2024-25.

Street vending two-step: LA’s library system has rolled out an innovative education platform to help street vendors familiarize themselves with the city’s regulatory framework, helping bring fruteros and tamaleros up to code. Evidently officials in Huntington Park are not feeling so benevelot; the low-income city in southeastern Los Angeles County has opted to start cracking down on its own vendors, who have long made up a vibrant part of the urban fabric.

Ebike subsidies roll on! D.C.’s city council approved a bill that subsidizes cargo ebikes by up to $2,000 and regular ebikes up to $1.5k. The program has half a million dollars allotted to it.

3PD roundup: Delivery Hero may sell SE Asia units to Grab. Uber Eats to take SNAP, EBT, health benefit payments. DoorDash debuts eight new grocery options. And oh ya: Instacart went public.

Beggin’ for the better Bergen: Take a tour of the beautiful new bicycle tunnel built to serve Bergen, Norway’s second city. Constructed as part of a larger transportation package that included a light rail line, the projects are meant to improve a city that has modeshare and land use that tends to look more American than Scandinavian. Decades after ripping out its trams, the city spent about around $30 million per mile on the first phase of its LRT system, about 1/3 of what a similar project would cost in America (keep in mind that Norway actually has a higher per-capita income than the U.S.)

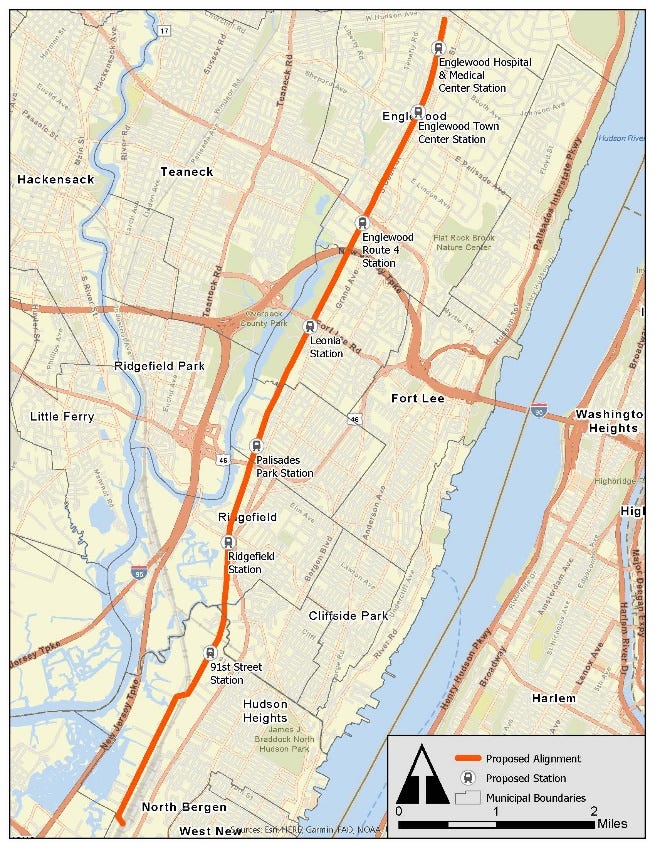

Zooming over to the Bergen County that sits across the Hudson from Manhattan, things are less rosy. Despite being home to some of the densest municipalities in the country, the county currently has no LRT or subway service. And plans to rectify that just got curtailed, as the FTA ordered NJ Transit to redo an environmental impact report, finding that some of the data in it was too old. Gee, I sure hope the new report finds that trains are greener than cars! In 2020 the ~9 mile project — which would largely reuse an existing freight corridor — was budgeted at about $133M per mile.

A few good links: Automakers under pressure to resolve strike. GM Brightdrop improves Trace cart to include smart locker-esque customer pickup options. D.C. slows down implementation of fines for blocking bus lanes. President Biden unveils American Climate Corps. Vancouver loses Chief Planner, fourth to leave since 2012. Mexico launches train services in Veracruz. Vote for better bus shelters. LA Metro finds that running more service gets you more riders.

Until next week!

- Jonah Bliss & The Curbivore Crew