Earning Season, Election Reason

Join us at Tuesday's Delivery + Mobility Happy Hour in Downtown LA

Next week is shaping up to be a huge occasion for the worlds of mobility and delivery, with amazing events from our friends at CoMotion, Auto Mobility, and more. So whether you're just in town for a few days, or are a SoCal staple, be sure to stop by Tuesday’s industry happy hour. We'll be gathering the brightest minds from the worlds of last mile delivery, transportation, open data standards, and so much more - 4:30 to 6:30 PM at Far Bar in Downtown LA. RSVP now to join us, spots will fill quickly. And thank you to our partners at HUB Insurance for their generous support of this festive gathering.

Q3 Results Showing Mixed Results for Curb Economy

With Q3 earnings season in full swing, a number of seminal delivery and mobility companies have reported their latest quarterly earnings. Firms more focused on food delivery are showing surprising resilience in the face of inflation, while the TNC side of things are producing improvements on a more modest scale. (We’ll have to wait another week to see results from the public micromobility players: Bird and Helbiz.)

DoorDash beat its earning estimates, with revenue growing 33% to $1.7 billion compared the year prior. Company CFO Prabir Adarkar stated that while some customers are responding to inflation by shifting their preferences down-market, they’ve shown no signs of giving up on their new delivery habits. Capitalizing on that trend, DoorDash is continuing to push into grocery and convenience delivery, which is up 80 percent YoY.

Over in Europe, market leader Delivery Hero saw similar year over year growth of 30%, excluding its Asian business where numbers were skewed by Covid trends. The company is claiming its core platform business reached break-even, and is projecting the overall business should be in the black by the second half of 2023. Gross marketplace value was a whopping 11,449 million Euros ($11.663 billion) for the quarter, with the bulk of that revenue delivered by Singapore-based Foodpanda.

Spanning delivery and mobility, Uber’s stock popped 11% as it announced its rideshare business had finally recovered from Covid - hitting an all time high for gross bookings. Both the mobility and delivery businesses showed gross bookings of $13.7 billion, while its freight arm hit $1.75 billion in sales. Active platform users climbed 14% to 124 million.

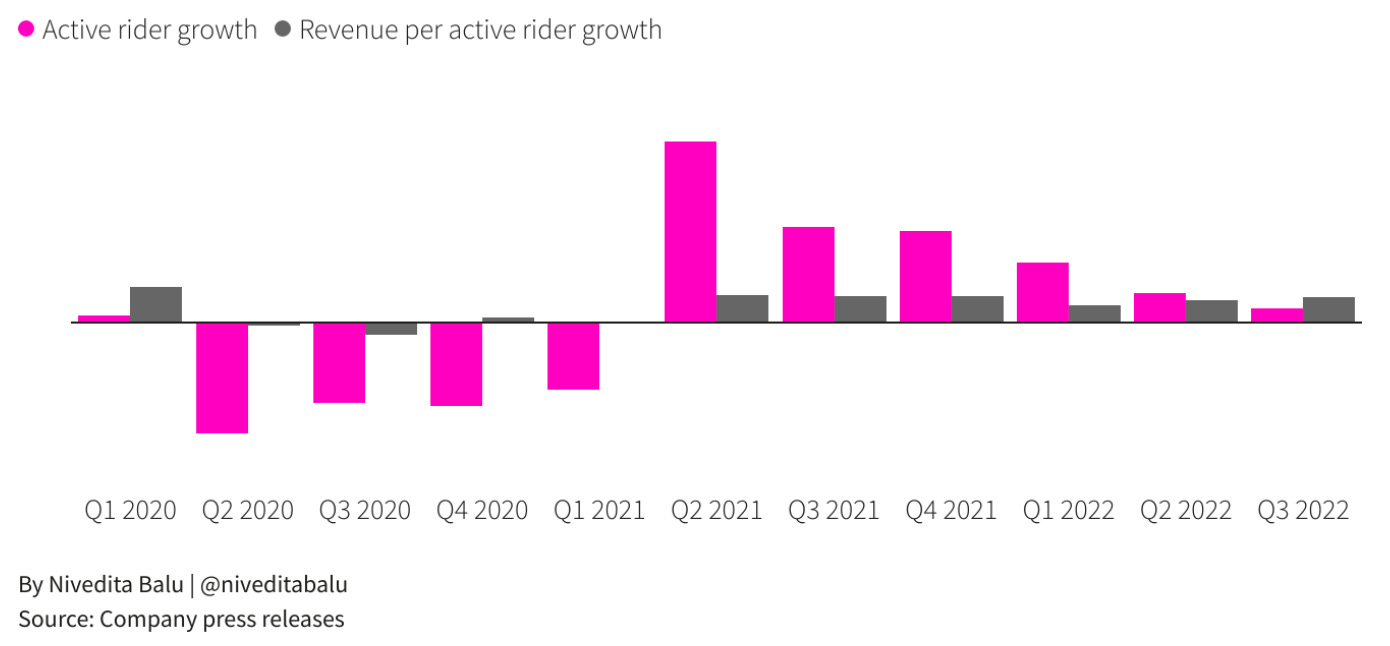

Lyft had a tougher quarter, as its delivery initiative is too small to make up for a softening in its core mobility business. Rider growth stalled as the company grapples with higher insurance rates. Adding to the negative sentiment, the company cut 13% of its 5,000 person workforce.

Moving on to Tuesday’s U.S. election, while the results look promising for democracy, they were also a pivotal night for mobility and gig-worker businesses.

On the public transit side of things, Michigan made some huge moves to kick its auto addiction. Not only did Detroit and its suburban neighbor counties vote to spend nearly $1 billion to improve regional transit, the smaller Ann Arbor-Ypsilanti region also voted yes on $110 million in public transit improvements. Over in Minnesota, rail-fans are optimistic that the state’s new Democrat trifecta will spend some of the state’s surplus to fund a 152-mile passenger rail corridor.

In Massachusetts, voters approved a hike to the state’s top income tax rate, with much of the new funding going towards transportation. Separately, Fall River and New Bedford voted to join the MBTA, strengthening the prospects of a new rail line for the Boston region. The news was less positive in Florida, as both Orange and Hillsborough counties voted down transit sales taxes.

In SF, voters were given the rare opportunity to decide for themselves what they’d like a street to look like. By an overwhelming majority, San Franciscans opted to keep JFK Drive car-free, in a move that reaffirmed the city’s post-Covid move to keep cars out of its grand Golden Gate Park. On the state level, Prop 30 failed, as Californians opted not to tax the rich to further subsidize electric vehicles. Perhaps voters thought all the recently passed Federal money was more than enough, given the long wait times to score an EV of any price…

And in Portland, Maine, voters rejected a minimum wage proposal that would have seen gig workers get a pay boost to $18 per hour.

HOT INDUSTRY NEWS & GOSSIP

What’s in the box?! For Blue Apron, it’s bad news. The meal kit delivery stalwart is hurting for cash as a key investor withholds funding. The publicly listed company is now likely to breach its minimum liquidity covenants.

Food halls deliver the goods… Burger King just opened a handful of delivery-focused food halls; this might make its recent breakup with REEF make more strategic sense. On a smaller scale, Chili’s just launched its own delivery and takeout-only venue; sounds like you’ll be enjoying those Baby Back Ribs at home. And in California, food hall replicator Local Kitchens just opened a 10th location. Meanwhile, Taco Bell is turning to DoorDash for third party delivery, and Paris is struggling to say “adieu” to dark stores / ghost kitchens.

Curb management comes to SF and LA: The City by the Bay is working on a parking and curb management project in its residential Sunset District. In Los Angeles, our friends at the LA Cleantech Incubator are looking for partners to support a curb management, loading zone and LMD pilot. Apply by November 30th. Across the country, Boston is looking for improved curb designs to manage flooding. And in a very pedestrian friendly move, neighboring Cambridge voted to ban right turns on red.

Fresh cash for gig work! Algeria’s Yassir raised a massive $150M Series B, led by Bond. While this company has flown under the radar in the U.S., it has over 2 million users in North Africa, and is making inroads into Francophone regions including Montreal and Paris, offering a mix of ridehailing, food / grocery delivery, and banking services.

Beat’s beat: It’s a less happy story for Daimler owned Beat, which offered ridehailing and courier services in LatAm and Greece. The auto giant is throwing in the towel on this Uber competitor, opting to instead concentrate on its other Uber competitor: Free Now. (Not to be confused with Share Now, which was created by the merger of DriveNow and car2go, and was owned by Daimler and BMW, before being sold to competitor Stellantis. Confused yet? So are OEMs when it comes to new mobility…)

Behind the scenes with Serve: WSJ has an in-depth profile on delivery-bot startup Serve, as well as AV players like Waymo, highlighting the key role that remote operators have in the nascent industry. For every four bots on the street, there’s one human watching the screens.

A gamble on rail? Brightline West took a tantalizing step towards constructing its SoCal to Vegas HSR, as it started the environmental review process. Rail-fans may be experiencing deja vu though, as the company has previously promised to break ground, only to pull back in light of financing shortfalls.

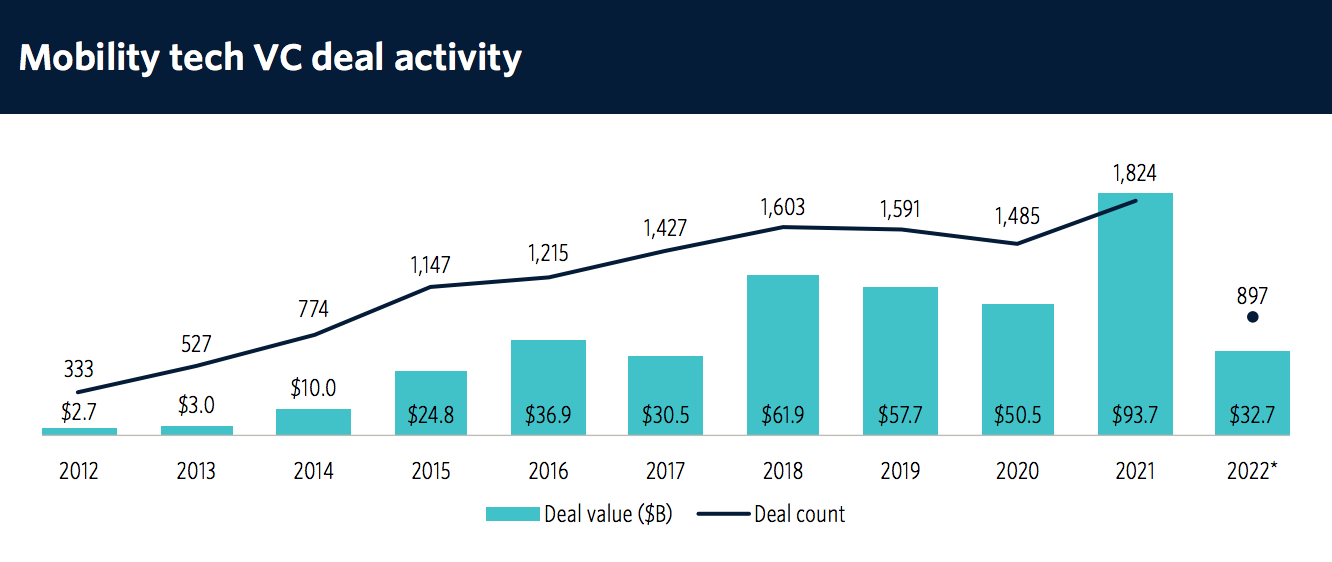

A cold winter for mobility tech? A new report shows a 79% YoY decline in mobility tech funding.

Amazon and Rivian hit a milestone: There are now over 1,000 of the Bezos-backed electric delivery vans plying the roads. While these haulers were initially constrained to a few cities (including Chicago, San Diego, and St. Louis) they’ll be serving over 100 municipalities by Christmas.

Tacos + tricycles… Enough said!

Deja vu all over again: About 22 years ago, urban delivery pioneers Kozmo and Urbanfetch shut down. Can we learn anything from their Y2K era epitaphs? (Maybe less can be gleaned from this hilarious reminder of what turn of the century web design looked like…)

The usual link suspects: GoPuff’s founder explains the company’s missteps, misgivings on 15-minute delivery. Biden’s recent visit to LA may beget fresh cash for rail project. Get to know America's first all electric transit agency. DoorDash to offer new benefits to restaurateurs, including healthcare and benefit tools. From payphone to EV charger? A look at the future of urban robotics. Ebike library launched in Rancho San Pedro. NYC proposes dedicated bus and bike lanes on one of its not particularly famous bridges. Data & The Multimodal City webinar now available on YouTube.

Don’t forget there’s only a few days left to snag a $99 Curbivore ticket, and to stop by Tuesday’s happy hour.

- Jonah Bliss & The Curbivore Crew