Delivery bots in 2024

Move America heads to Austin

Have you heard about America's #1 tech mobility and start-up show?

If not, buckle up and hold onto your hats because our partner MOVE America is revving its engines and heading to the Austin Convention Center on September 26 - 27 2023!

2022 was off the charts, but this year MOVE America are taking it to a whole new gear - 4,000+ attendees, 500 speakers, 26 conference stages and 450 exhibitors guaranteed to rock your world!

Delivery robotics’ state of play as industry readies for first public listing

Over at OttOmate, we’ve just finished up an in-depth digest on the state of delivery robotics, in light of Serve’s upcoming public listing. Do read the whole thing for further insights on each player; I’ve excerpted part below:

Over the past few months, we’ve sat down with leadership from all of the major delivery robotics startups, gathering their insights and prognostications during an interesting inflection point for the industry. On one hand, tomorrow never comes as fast as predicted, especially if your prediction was used to raise a big venture round back in the halcyon days of early 2022. But at the same time, a number of players have made unmistakable progress – not only securing major partnerships “vote of confidence” partnerships, but with a number of companies now reporting profitability on a per-delivery basis.

With Serve, one of the industry’s larger players, making waves late last week with the news that it planned to go public, this felt like a natural time to sift through all of our interviews, and suss out a path forward for the entire personal delivery device (PDD) space. With the major players differing on key decisions like form factor, autonomy, monetization strategy, target customer and more — there are still a number of paths forward.

How deep is your tech?

The major inflection point the industry is still divided over is how deeply to invest in autonomy. While we’ve seen some startups falter at the extreme ends (fully autonomous Nuro slashed staff count and delayed its next hardware release, while completely remotely-operated startup Tortoise wound down,) the remaining contenders are all over the map in terms of how autonomously they operate.

In its SEC filings, Serve reported that its Level 4 autonomy is effective >80% of the time; competitor Starship claims 99% autonomous operations. Other players like Coco have stuck with remote-operations, whereas Kiwibot recently jumped from Level 3 to Level 4 automation. One question that’s dogged a number of companies as they try to move up the autonomy scale is just how efficient they are with their human pilots and drivers. Industry sources have reported that some “autonomous” players still essentially employ one remote driver / minder for every robot; that’s great news for suppliers like Remotics, but not good for bending the cost curve.

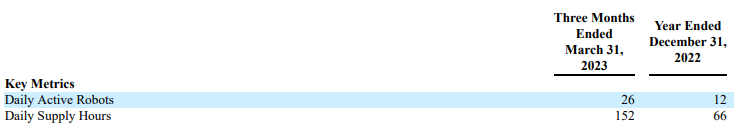

In theory, opting for more autonomy should mean more fixed costs as you pour money into R&D, but low variable costs, as each robot doesn’t require another corresponding human to work it. But the financials only really work out if you can keep your robots working around the clock. In its disclosures, Serve noted that while it grew its “daily active robot” count from 12 to 26 between 12/31/22 and 3/31/2023, its daily supply hours” only rose to 152 – meaning each PDD is ready to accept jobs 5.85 hours per day, implying even fewer hours are then spent on delivery runs.

Other tech issues still divide the field: how many gallons or grocery bags of storage should your robot hold; how heavy should it be; three wheels or four; why does Refraction’s vehicle look like someone stole The Terminator’s head? But ultimately each decision is driven by a combination of rationalizing costs, while trying to maximize each bot’s earning capacity.

Fundraising fun

Speaking of earning, money has obviously been on the minds of industry leadership. In 2021 and 2022, low interest rates and a COVID-induced boom in delivery meant Nuro could raise a whopping $2.1 billion dollars; Starship raised $100M in 30 days; Coco’s Series A was a mighty $36M. Heck - that all sounded reasonable in an era where companies were raising billions of dollars on the idea that they would cover the planet in dark warehouses so humans could deliver you candy bars in 15 minutes or less. (How’d that work out?)

These days, startups are learning to stretch their dollars, and finding they have to get creative when it comes to fundraising. Kiwibot turned to Kineo Finance to raise $10M in asset-based financing, essentially using the new bots it would build as collateral for the loan. Before announcing its turn towards the public markets, Serve went from a crowdfunding round to $3M in bridge financing.

But with both venture funding and the NASDAQ looking a bit healthier these past months, perhaps things are turning around for the industry. Or maybe, some players will manage to make it out without any more external capital. Starship recently announced it was profitable in select markets, and Cartken claimed it was in the black on a per delivery basis. Remotely operated players are making financial headway too. One familiar brand (that has asked not to be named) is also profitable on a per delivery basis. Reflecting on his company’s financials, Tiny Mile’s Ignacio Tartavull shared that his company was generating about $1M in revenue on $2M in burn, which works out to roughly 10x of Serve’s revenue on 1/10 the costs. With delivery behemoths like Uber and Delivery Hero now breaking even, perhaps we’ve finally reached a point where delivery can make money?

Which way are the policy winds blowing?

When we think about the policy and laws dictating robotic delivery operations, there are really two distinct subsets: where PDDs can operate, and how they can operate. That latter question has been left relatively unaddressed by both the public and private sector; we’re in the “primordial soup” phase, where each operator evolves its own answers to the questions of not just how the insides of the machine work, but how that machine communicates to the public, and what sort of reliability it must offer.

One organization, the Urban Robotics Foundation, is trying to standardize the industry, as it shephards ISO 4448 towards finalization. As sidewalk robots proliferate, it only makes sense that the public should expect predictable behavior when it comes to issues like yielding to wheelchair users, communicating intention to cross a street, waiting for other vehicles with right of way, etc. While the public might find robots crashing through caution tape amusing these days, that behavior won’t be tolerated at scale.

The Open Mobility Foundation also has its eyes on delivery robot regulation, as version 2.0 of its Mobility Data Specification now supports flexible data formats for tracking PDDs. Cities as varied as Bogotá, Los Angeles, Miami and Auckland use the framework to track and enforce micromobility usage; expect to see more and more cities use it to monitor delivery robots, and potentially set “no go” zones, in the near future. As of now, Kiwibot appears to be the only PDD company that’s an active OMF member, helping shape the software standard could give them a leg up in the long run.

Cities, especially in North America, have continued to take a broadly hands-off approach to regulating delivery robotics. There are some notable exceptions: Toronto passed a ban in late 2021, sending Tiny Mile’s robots (but not all of its leadership) down to Miami. San Francisco banned the bots way back in 2017, back when Marble was considered a serious competitor. While sidewalk bots are currently not allowed on public streets in Las Vegas, a legal update may soon change that.

Going to market off going to the market

On the other hand, Los Angeles, along with neighboring Santa Monica, has continued to offer a relatively hands-off approach to the industry…

Hands off: It’s been a wild few weeks for robotaxis in San Francisco, with the cars jamming to a halt on Friday evening, one day after receiving approval by the CPUC. Now Waymo has announced its set to start charging for fares on Monday; city leaders are in turn asking for the commission to rescind the approval, claiming CEQA issues.

Is delivery diverging? As Q2 earning season wraps up, we’ve seen different routes for the delivery industry. Retailers are still seeing the segment grow, as Walmart had a monster quarter, and Target saw “same day services” (like Shipt) stand out as a bright spot in its otherwise weaker results. It’s less rosy for restaurateurs, as Cava, Chipotle and Sweetgreen are seeing their digital sales mix falter, as consumers opt to save on tips and via pickup. But Chili’s offers an interesting solution for that issue: it’s moving It’s Just Wings — a brand that was previously only available for delivery — onto its in-store menus.

Yellow cab meets green Uber: NYC’s TLC proposed a Green Rides rule, whereby all rideshare vehicles will have to be zero-emissions, or wheelchair accessible, by 2030. A public hearing is set for September 20th.

A new electric van player emerges: Arizona-based ElectraMeccanica announced it was merging with the UK’s Tevva, in a bid to combine the two EV upstarts into a van and truck manufacturing heavyweight. While Tevva recently began delivering vehicles to British customers, it’s capacity limited to 3,500 units per year. Adding on ElectraMeccanica’s Mesa-based factory, idled since the startup recalled its Solo minicars, means the company can manufacture an additional 10,000 by 2026, servicing the American and EU markets as well, while tapping in to new U.S. government incentives.

Some very lovely street vending news: Get to know the Long Beach palatero that sells oceanside ice cream for dogs. Meet the migrant children selling candy in NYC to make ends meet. As temperatures rise, working in a food truck could become more dangerous.

Well that wasn’t so hard: After just a few weeks of restriping work, LA’s finished a new bus lane on a busy segment of La Brea — connecting Hollywood and the B Line with the under construction D Line extension in Mid-Wilshire. A second segment to the South, where it would hit the E Line, is delayed by Councilmember Hutt; if you live in district 10, consider weighing in.

Cargopolis! NYC is amending its ebike rules, looking in to usher in a wave of cargo bikes. When the state approved ebikes waaaay back in 2020, it banned four-wheelers and vehicles over three feet wide. Now the city is looking to allow vehicles as wide as four feet, but no longer than 10 feet (including trailer length.) Expect to see the landscape shift from bikes and trikes with trailers to more purpose-built EAVs and cargo bikes, a la Europe.

A second shot for store hailing: LA-based Robomart, which briefly rebranded as Conjure, raised a $2M round to advance its store-hailing Haven vehicle. Brands like Fatty Mart and Ben & Jerry’s have expressed interest in using the van to bring up to 300 SKUs directly to consumer doorsteps.

Dallas to subway: drop dead! The Big D killed plans to build a subway through its downtown, citing rising costs. Currently the light rail system can take 19 minutes to crawl 3 miles, plus transfer time, making it impractical for reaching jobs in the region’s booming exurbs. Given the city’s many parking lots, might they consider building an elevated train instead?

Top states for dog-friendly dining: Surprise, surprise — it’s outdoor dining friendly locales like CA, TX and Florida.

If it was good enough for America in the ‘50s, surely it’s a good idea for Berlin today! Germany’s capital is bulldozing a number of its famous nightclubs to expand an in-city freeway. Scheiße!

A few good links: London looks to express busses to connect outer neighborhoods. NYC gives outdoor dining final OK. Pico retools subscription moped service. Ford opts for monthly payments on AV tech. DD launches salad brand. UK trials universal scooter noises. Charities combat universal ebike chargers. Tel Aviv LRT set to open. Matt Newberg and Dante DiCicco talk restaurant procurement. QSREvolution heads to Georgia.

Until next week!

- Jonah Bliss & The Curbivore Crew