Check Out LA's Latest Subway Stations, Opening in... 2047?!

Meet the K Line Northern Extension

America doesn’t build much in the way of meaningful new public transit, opting for cute streetcars or middling BRT projects instead of building tunnels and bridges. So when the plans for a new subway line start to really come together, as they now have for LA’s K Line Northern Extension, they’re worth digging in to.

The project would build grade-separated light rail in neighborhoods like Hollywood, West Hollywood, the Miracle Mile and Mid-City, serving one of the region (and country’s) densest stretches of multi-family apartments, office towers, cultural institutions and of course some charming 1920s/30s single family homes that NIMBYs will behead you over even suggesting should be upzoned.

There are three proposed routes that all start at Expo / Crenshaw at the southern end, with one largely serving La Brea, one that goes a mile west to Fairfax, and one with an even bigger detour to San Vicente. So let’s take a look at where the Draft EIR proposes putting new stations.

LA Brea Route

Crenshaw / Adams — with an entrance either on the SW or SE corner. This would serve each of the three route options.

Midtown Crossing — AKA that horrible intersection where Venice, Pico and San Vicente all try to kill each other. Entrance is under what is currently a Ralph’s supermarket. This would serve each of the three route options.

WIlshire / La Brea — station entrance is at the NW, along with a connection to the almost complete D Line, which has an existing entrance to the SW.

La Brea / Beverly — entrance is either at the NE or NW.

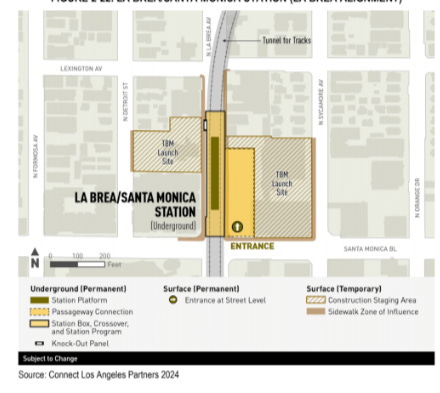

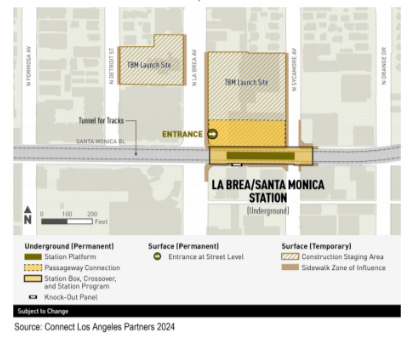

La Brea / Santa Monica — the station entrance will be to the NE for any route, but the orientation of the station shifts depending on if the La Brea or the Fairfax or La Cienega options get built.

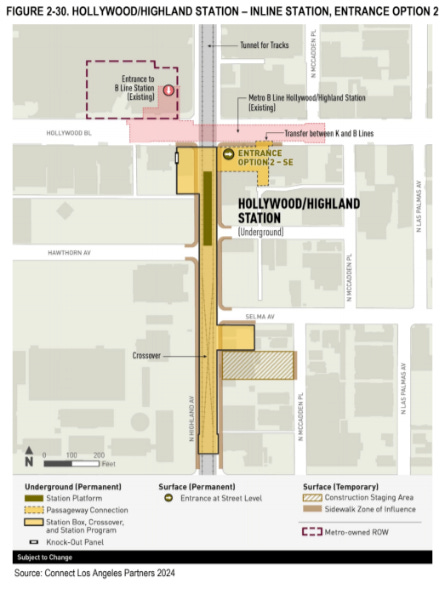

Hollywood / Highland — entrance is either SE or SW, alongside an interchange with the B Line and its existing entrance to the NW. This would serve each of the three route options.

Hollywood Bowl — this is an optional add-on for each route, with the entrance either at the East side of Highland (by Odin) or to the West, in the Bowl’s forecourt.

Fairfax Route

Wilshire / Fairfax — entrance is to the NW, along with an interchange with the D Line and its existing entrance to the SE. This serves both the Fairfax and La Cienega route options.

Fairfax / 3rd — entrance to the SE, with a possible second entrance to the NE, like in a civilized country. Earlier plans suggested this station might be at Fairfax / Beverly, but evidently there’s better ridership closer to the Farmers Market, The Grove and Park La Brea. This serves both the Fairfax and La Cienega route options.

Fairfax / Santa Monica — entrance to the NE or SE. This serves both the Fairfax and La Cienega route options.

San Vicente Route

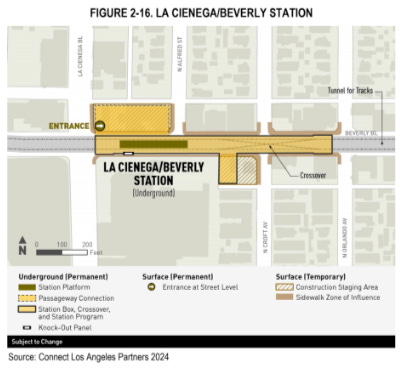

La Cienega / Beverly — entrance is to the NE. This station would provide access to the Beverly Center and Cedars Sinai.

San Vicente / Santa Monica - entrance is either to the SE or NE, not far from the Pacific Design Center.

Next stop: 2047?

As currently planned, Metro doesn’t think this will open until 2047, give or take the usual delays. So why start planning this early? There are plans to accelerate funding, if the local jurisdictions can agree to form tax increment financing districts. The biggest issue is of course the cost, with the longest option projected to cost $14.8 billion. Metro had previously mulled an above-ground or partially at-grade option to trim the budget, but caved after mild protest. I would suggest that bringing those options back would not only save money but could make the project nicer — these are overly wide streets that could use the slimming down that comes with non-tunneled transit. And of course the reason they’re so wide to begin with is because they were designed for rail transit ~100 years ago. Let’s make what’s old new again.

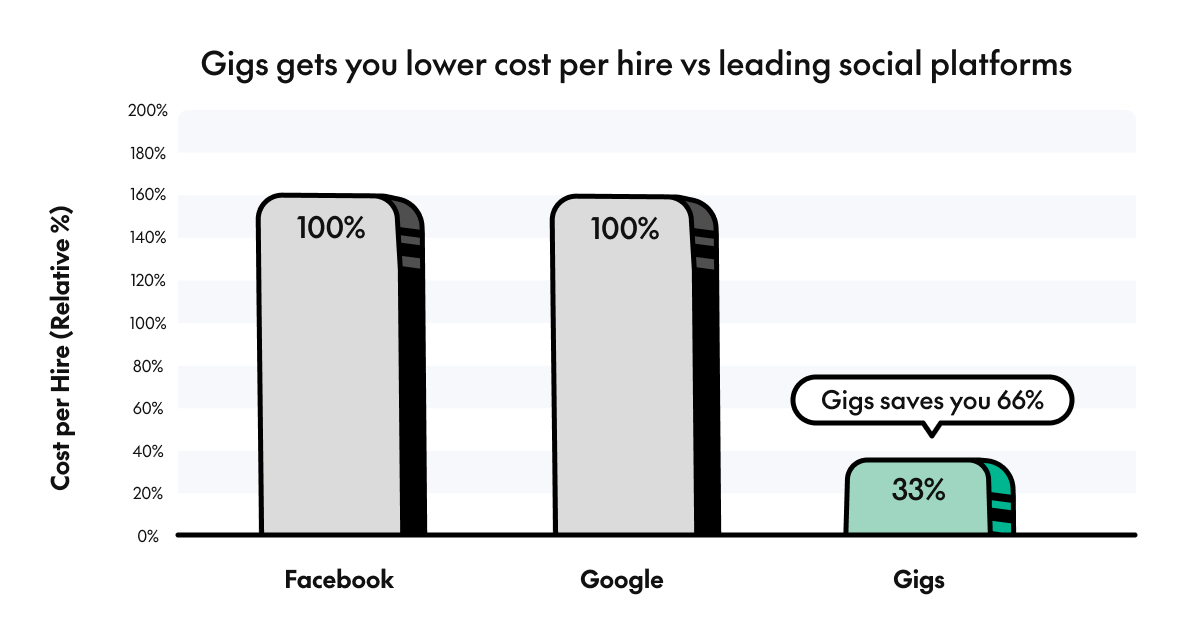

PARTNER | Gigs Gets You a Lower Cost per Hire

Gigs empowers companies like GoPuff to hire gig and hourly workers (either gig or W2) at the lowest possible cost per hire. We specialize in high-volume, high-churn roles such as warehouse workers, delivery drivers, and general labor positions. Our extensive network ensures we quickly reach the right applicants in any market. We consistently deliver hires at a lower cost than Facebook and Google, making us the most cost-effective solution for your hiring needs.

Learn more at getgigs.co/employers.

HOT INDUSTRY NEWS & GOSSIP

Is food delivery killing rideshare? A fascinating new study found that the introduction of Uber Eats in select neighborhoods led to a decline in ridesharing usage. Not because passengers stopped Ubering to restaurants and had the food come to them, but because gig workers instead opted to perform deliveries, driving down rideshare supply, and pushing prices up. I wanted to dig into this study further, so I reached out to Professor David Chung, one of its researchers.

Most of the data I've seen suggests that rideshare pays better than delivery. Why then do you think so many rideshare drivers were pulled into delivery work - were they engaged in price discovery, or perhaps drawn by other factors (safety, trip duration...) or maybe the local conditions differ in NYC?

Prof. Chung: You are correct - as you said, on average, rideshare pays better than delivery. In our context, NYC, “The average hourly income (net of expenses) in NYC was $14.25 for rideshare drivers and $12.21 for food delivery couriers” (p.19)

However, if we look into each hour within a day, it may not be the case. What we have found (and confirmed with the drivers via interviews) is that: drivers will work for food delivery when they have a plenty of idle time (i.e., non-rush hours) while continue to focus on rideshare during peak time (i.e., rush hours).

This was because during non-rush hours, drivers may serve more food delivery orders than rideshare trips and earn more (even if each delivery pay less).

So, drivers were not permanently switching to food delivery; rather they were oscillating between rideshare and food delivery to maximize their profits.

While rideshare usage declined due to higher prices, there are other ways to meet that latent demand for travel. Did you look at if those zones that saw reduced ridesharing saw a commensurate increase in say transit station entrances, Citi Bike usage, taxi cab hailing, etc?

Unfortunately, our data does not have information on subway, bus, or bikes. That said, we analyzed how taxi trips were affected by Uber Eats and found no effects.

We also analyzed how rideshare trips were affected by the launch of another food delivery platforms, DoorDash, and also found no effects.

If our results were caused by demand shift, we should have seen reductions in 1) taxi trips after Uber Eats or 2) rideshare trips after DoorDash.

With both analyses showing no reductions, we indirectly concluded that our results were not caused by demand shift.

The zones are quite small, and this workforce is inherently mobile. If workers are substituting ridesharing for food delivery, wouldn't workers in an adjacent zone (with fewer restaurants) simply move into the most restaurant-rich zone to serve that one instead? How do you account for that sort of correction / balance to the network?

You are correct, which relates to a potential violation of the Stable Unit Treatment Value Assumption (SUTVA). In our context, rideshare drivers who worked in zones where no restaurants joined Uber Eats (control group) might move to zones where at least one restaurant joined Uber Eats (treated group) to work on Uber Eats, causing rideshare trip volumes in the control group to decrease. This would attenuate our estimates and make it more difficult to find results consistent with our arguments. Thus, our point estimates could be interpreted as the lower bound of the true effect size.

That said, to address this bias, we used a DID model that compared trip volumes of Uber and Lyft between Manhattan and boroughs outside Manhattan (i.e., The Bronx, Brooklyn, Queens, and Staten Island). Because drivers’ movement between Manhattan and outer boroughs is more costly and difficult than the movement between zones in Manhattan, we predict that the bias from the potential violation of SUTVA would be partially mitigated. The results show that rideshare trip volumes in Manhattan (where Uber Eats entered) declined significantly compared to trip volumes in outer boroughs (where Uber Eats did not enter at the time) after the launch of Uber Eats.

Prop 22 upheld: Uber and Lyft scored a big win in California this morning, with the state’s Supreme Court upholding the ballot initiative that gave gig workers some additional benefits, while avoiding classifying them as employees.

AVs avec moi? It’s been a huge week for the driverless taxi / autonomous delivery bot space, with Alphabet committing to spend $5 billion on Waymo, Zeekr teaming up with Waymo for new robotaxi vehicles, GM’s Cruise giving up on its Origin vehicle but looking to resume driverless trips by year’s end, Musk promising robotaxis by October in the face of a weak earnings report, Vayu Robotics debuting a new lidar-free delivery bot and Serve Robotics selling off $15M in new stock after an Nvidia-related surge in its share price.

New train gang: SEPTA has secured a contract for new subway trains, opting for a contemporary open-gangway model (meaning each train car is open to the next one.) Meanwhile, the MBTA is getting new battery-electric multiple units for its Fairmount Line.

Logistics’ lopsided logic: Tough news for the logistics space, with funding waaay down last year. European startups look to be the worst affected, with India and North America holding up better.

In other funding news… Looks like SPACs may be making a comeback? 🫠 Don’t make me and Greg Lindsay restart our podcast to yell about these! Speaking of icky money, the WSJ looks at JD Vance’s track record as a venture capitalist and it’s not so bueno. You’d have easily beat that MOIC of 1.67 by just parking your money in a friggin’ Nasdaq index.

The war on cars takes a highly saturated turn for the worse! Fortunately nobody was hurt except for a few taste buds.

A few good links: TWU sues MTA over quiet cuts to bus service. GridMatrix launches at Port Newark. NYCDOT plans mild street safety upgrades to Atlantic Av. LADOT’s Hollywood Blvd makeover is coming along nicely. CarPutty looks to reinvent auto financing as an open, revolving loan. In Westchester, residents fear grocery merger would kill off their smaller scale market that’s tucked between residential blocks — maybe we need to update our zoning so these sorts of stores are easier to open? FHWA looks to reinstate emissions targets after the rogue Fifth Circuit’s ruling. Malaysia looks to open data centers near Singapore, targeting processing-heavy applications.

Until next week!

- Jonah Bliss & The Curbivore Crew