Brooklyn's Hottest Ride? Amazon & Scoobic's Cargo eQuad

Uber, DoorDash & Lyft surge in Q3, Transit's electoral wins, CARB kills e-bike vouchers

Amazon turned heads last month when it announced plans to deploy thousands of eye-catching eQuads from Rivian spin-out Also. But anyone that’s been following the logistics giant closely knows that this isn’t its first foray into pedal-assist cargo bikes; Bezos and Co. have been experimenting with the form factor for quite a while now.

With that in mind, in early October I found myself on the not-so-mean streets of Red Hook, Brooklyn, New York, eager to check out some of Amazon’s eQuads in action.

Setting the Scene for the Quad Squad

Amazon’s Red Hook delivery hub doesn’t look like much from the outside — a nondescript warehouse on an industrial street, wedged between storage lots, IKEA and parking for a mediocre grocery store. Inside, though, it’s a micromobility hive: rows of compact four-wheelers charging, loading and getting dispatched to the nearby neighborhoods of Carroll Gardens, Cobble Hill and Downtown Brooklyn.

While this section of NYC may be scarred by Robert Moses’ infamous Brooklyn-Queens Expressway, the brownstone-lined streets themselves are narrow and quiet — except for when a double-parked car triggers an orchestra of beeping motorists.

That’s what’s drawn Amazon to these parts: while the company has gone big on this form-factor in Europe, South Brooklyn represents one of the rare patches of America where a pedaled vehicle might actually get from door-to-door faster than a van. Yes there are some nice environmental benefits, plus the upside of fewer parking tickets; but for Amazon, when you multiply a second saved on each order by the millions of transactions it processes every day, you can see how the economics alone make this a compelling pilot.

Spinning My Scoobic

Amazon is trialing a few different manufacturers; while I spied a few eQuads made by Germany’s Mubea, I was on site to get a test-drive of Spanish startup Scoobic’s hardware. Stepping into the vehicle, it’s not all that different from what I encountered with the Honda Fastport: bike-like handlebars, a swept-back windscreen and some simple electronic controls. Behind the driver is where the real magic lies: a big ol’ box capable of carrying about 550 pounds of goods.

Taking the eQuad out for a spin feels familiar: if you’ve ridden a bike, you can figure these contraptions out in a half-second. And the pedal-assisting motor means the bike is doing way more work than you are. One quibble — Amazon has asked its eQuad hardware partners to limit vehicle speeds to 11 MPH max — that was okay in the parking lot, but could be a bit scary when riding alongside real traffic.

In true Amazonian fashion, these eQuads aren’t actually being operated by Amazon employees, instead multiple delivery service providers (read: contractors) hand them off to their own gig workers. Scoobic said that’s lead to a bit more wear-and-tear than the company sees in its European operations, but coming revisions will further toughen up the hardware.

The Road to Scaling

So far, local reception has been mixed. Mobility-heads and environmentalists appreciate the move away from big, energy-intensive trucks and vans, while others fret about losing bike lane space to something a tad bigger than your standard two-wheeler. But Amazon seems committed to the cause; chatting with Emily Barber, Director of Amazon’s Global Fleet, she says, “We’re always looking for ways to improve our operations and positively impact the communities in which we operate. As we’ve grown our transportation network, we’ve learned that there is no one size fits all for delivery. Micromobility solutions, such as e-cargo quads, help us address the unique complexities of delivering packages in big, dense cities by enabling same-day deliveries, while reducing noise and congestion.”

Last year, Amazon delivered a whopping 170 million packages via micromobility modes like the eQuad, across European cities including London, Norwich, Paris, Naples, Florence, Barcelona, Hamburg and Belfast. Here’s hoping their success in Brooklyn leads to a similarly scaled roll-out across the United States.

PARTNER | Join Us at CoMotion LA - Nov. 12-13!

The future of American mobility is at an inflection point. Are you prepared? CoMotion LA ‘25, Nov. 12-13 ‘The New Mobility Playbook’ brings together an unprecedented array of thought-leaders, mayors, innovative policymakers, technology founders, VC investors and international delegations to discuss what’s next. Also explore the latest mobility-focused data and digital tools as part of a special OMF Summit Track and much more.

Mobility leaders confirmed to speak include:

Rex Richardson, Mayor, City of Long Beach

Marcel Porras, Deputy Chief Innovation Officer, Los Angeles Metro

Andrew Glass Hastings, Executive Director, Open Mobility Foundation

William T. Panos, SVP - Transportation, LA28 Olympic & Paralympic Games

Sarah Gates, Director of Corporate Affairs & Governance, Wayve

Shin-pei Tsai, Chief Research & Data Officer, City of Boston

Shaz Umer, Director of Strategic Initiatives, Office of the Secretary, U.S. Department of Transportation

And many more! Join the movement: register now and save 30% with code Curbivore-Network.

HOT INDUSTRY NEWS & GOSSIP

Electing for more transit: Tuesday’s elections saw voters pull the lever for improved mobility from coast-to-coast. Denverites said yes to $441.42 million in bond funding for complete street and biking infrastructure, while ski towns like Yampa Valley and Mountain Village also opted-in for improved transport. Cambridge, MA elected a slate of pro-biking councilors, while locals in Mecklenburg County (Charlotte, NC) okayed a $20 billion trains and roads sales tax. A number of rural areas said yes to transit too, while the big city folks in NYC passed a ballot measure that should reduce the city council’s ability to stymie housing production.

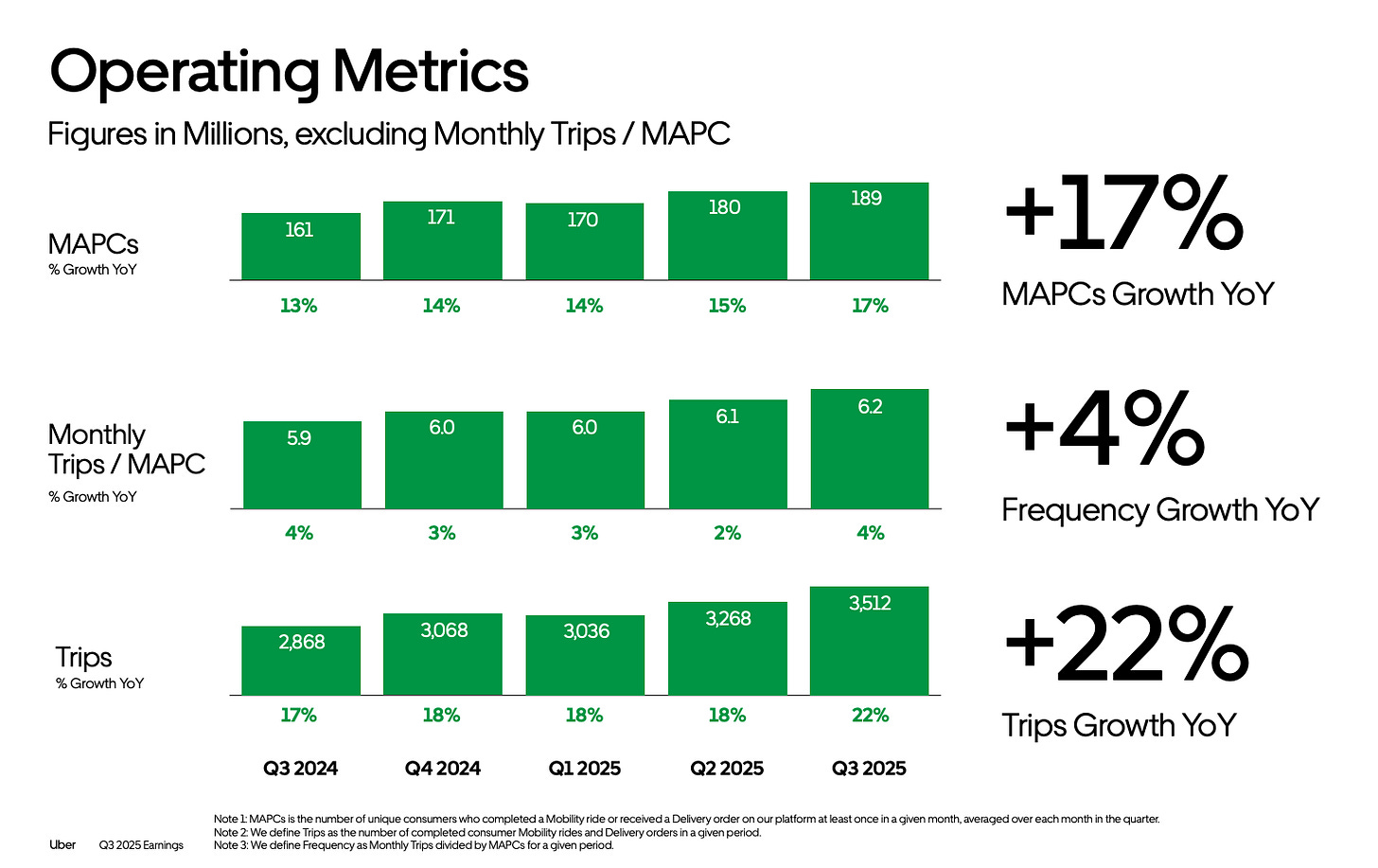

Uber skips a stop? It was also a big week for the TNCs and 3PDs… Uber kicked things off, with Q3 revenue up 20% YoY to $13.5 billion. Delivery gross bookings climbed 25% to $18.6B, while mobility was up 20% to $21B. Profit came a bit below estimates, due to legal / regulatory matters, (perhaps recent changes to CA’s insurance laws will put that in the rearview mirror?) sending the stock down 5%.

DoorDash doubles down: DoorDash grew at a similar pace, with delivery gross order value up 25% YoY to $25 billion for the quarter, and revenue climbing 27% to $3.4B. Coming off the back of its acquisition of Deliveroo, this represents the 3PD’s strongest growth in over two years. The company plans hundreds of millions of new investments in 2026.

Little guy Lyft looks up too: Lyft saw gross bookings rise 16%, to $4.8 billion, while revenue rose 11% to $1.7 billion. More importantly, the ridehailer swung to a profit for the quarter, making $46 million. And while everyone’s so excited about new AV partnerships, the pink mustache seems proud to be expanding human-powered services to Nova Scotia and Saskatchewan.

Discharged: With federal EV tax credits officially kaput, electric vehicle purchases are trending doooown. J.D. Power predicts sales fell 43% YoY in October. This in turn is leading OEMs to shelve plans to introduce smaller, cheaper EVs: Kia just pushed back plans for the U.S. launch of its EV4. Meanwhile in Germany, installations of new EV chargers looks to be slowing down.

Another mini-car not for Americans: Chinese moped maker Niu is expanding into micro-cars (or as Europeans like to call them: L6e quadricycles.) Meet the Niumm, capable of going 45 km/h (28 mph) for 70 km (43 miles), while powered by the same swappable batteries the brand uses in its scooters. Expect the price to come in around $8k.

Name ‘em and shame ‘em! The California Air Resources Board (CARB) is quietly winding down the California E-Bike Incentive Project, which offered a $2k subsidy on electric bicycle purchases. While the $30 million program still has $18M in funding left, CARB is choosing to transfer the money towards its Clean Cars 4 All program, which subsides EVs for low income Californians. The real problem is that instead of administering the e-bike voucher system internally (state capacity!) CARB subbed it out to Pedal Ahead, a San Diego non-profit helmed by Edward Clancy that continuously failed basic financial reporting requirements, delayed implementation for two years, and mixed funds with its leader’s for-profit business. The California Bicycle Coalition has a petition up to demand better from elected officials.

A nice exit for curb-tech: Curb management startup Populus, founded by Dr. Regina Clewlow in 2017, was snapped up by parking tech operator IPS Group. On the other side of the exit-spectrum, corporate travel platform Navan’s IPO saw shares fall 20%, as investors worried that the government shutdown meant the SEC hadn’t finished scrutinizing all the company’s listing docs.

In data spec news… The Open Mobility Foundation officially released version 1.1 of the Curb Data Specification. It includes improvements to curb objects, enforcement, payment methods, real-time events and computer vision.

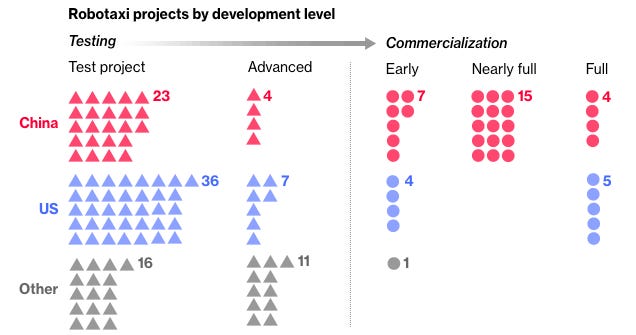

Too many robotaxis? By Bloomberg’s count, Chinese companies have a whopping 53 autonomous ridehailing projects being tested or commercialized, besting American startups by an inch, and the rest of the world by a mile. Investors are starting to worry that this cash-burning industry can’t support that many players: competitors WeRide and Pony AI both just started trading on the Hong Kong market, and saw their shares immediately fall.

No, it’s not just your eyes: Car headlights really are getting more blinding. U.K. regulators are looking to crack down on the problem. Could we get some of that enforcement action around these parts?

CTA saved? It’s not secret that big city transit operators are in trouble, with downtown-bound ridership still weak and federal funds dried up. Illinois leaders stepped up to save Chicago area transit. The $1.5 billion package means no cuts to local service, financed by a 45 cent increase to road tolls, changes to sales taxes, and the flexing of highway funds towards transit, plus it enables restructuring the region’s transit authorities to better integrate service across the ‘burbs. The bill also includes some pro-housing and anti-parking goodies. Oh and the City of Chicago is buying the local Greyhound terminal, for good measure.

A few good links: Hooray for NYC’s bounty hunters cracking down on idling and polluting cars and buses. European leaders look to boost train speeds. Who won the 2025 Pittsburgh Parallel Parking Championship? Hailing from Bismarck, North Dakota, Pavewise raised $2.5 million to improve public works contracting efficiency. Lidar-maker Luminar cuts heads. Nvidia teams up with Hyundai. Tesla recalls Cybertruck for the 10th time. Instacart adds AI solutions for grocery delivery, expands partnership with Kroger (following the supermarket giant’s expanded push with DD & UE.) Amtrak San Joaquins train rebranded as Gold Runner (not to be confused with Gold Rusher.) Uber eyes Getir as path to Turkish expansion. Paris plans underground delivery hubs (I still love this story!)

Don’t forget to score your Super Early Bird tickets to Curbivore!

- Jonah Bliss & The Curbivore Crew

The 27% revnue growth for DoorDash is impressiv considering the macroeconomic headwinds. Their Deliveroo aquisition seems to be paying off with that $25B in order value. With hundrds of millions planned for 2026, they're clearly doubling down on dominance in the 3PD space.