Better Credit Scoring Means Better Outcomes for Gig Workers

Meet Rollee. Plus, new quarterly earnings from Uber, Instacart and Lyft.

As gig work continues to consume more and more of the overall economy, one challenge can be that workers rack up ever patchier resumes, bouncing between five or more jobs at once. While that might be a slight annoyance for someone that likes to keep a pristine LinkedIn profile, it’s a far bigger issue when it comes to getting the credit necessary for major purchases like a car, or work tools. While the traditional credit bureaus still struggle with presenting a cohesive picture of the creditworthiness of a consistent gig worker, new tools like Rollee have emerged, that aim to better collect underwriting data. We checked in with Ali Hamriti, the French company’s Co-Founder and CEO, to learn more.

Let’s start with the elevator pitch: what’s Rollee, and what problem did you set out to solve?

Ali Hamriti: Rollee is a unified API that streamlines lenders’ income verification for a diverse workforce, especially independent workers. Gig economy workers and freelancers share their earnings through Rollee with our customers (lenders, banks, etc.) in order to be eligible for a car loan, cash advance, or insurance product. We also provide additional insights to financial institutions that lead to better decision-making when predicting a potential default.

Tell us a bit about your career background, and how you came to realize there was this underwriting and data issue?

I’m a former Data Scientist who quickly specialized in credit scoring modeling following my graduation. I helped leading European banks, and insurers review their outdated scoring rules for consumers and SMBs incorporating popular machine learning algorithms. Before Rollee, I was leading the data science department for a French fintech, building a new lending product addressing freelancers. We figured out how difficult it was to underwrite people with fragmented income properly. We started using an Open Banking provider and figured out how accessing income from the right data sources for freelancers was critical. That’s why I embraced the opportunity to build a new infrastructure connecting to freelance platforms, government portals and other alternative data sources to facilitate credit decision-making for this growing population.

What are the sorts of data points that Rollee can ingest, and why do traditional credit scorers miss them?

We ingest earnings and activity data points for freelancers. Analyzing earnings without activity for a freelancer doesn’t help to build a firm conviction on their risk profile. Being a freelance AI engineer and pricing your daily rate at 2000 dollars can allow you to work for a few months and get the same annual income as someone else working for a year. Regularly earning and working with Uber and Lyft will show your commitment to this job. Overall, we combine income and activity by providing a granular profile to our customers so they can make informed credit decisions. Traditional credit scores don’t get to this level of analysis for a population that needs it as they embrace a different way of work.

Who are some of your clients, and how do they use the data?

We're partnering with leading auto finance companies for ride-hailing drivers, earned wage access for freelancers, and management apps for gig workers. They use our data to centralize their user's earnings from multiple apps, make a loan decision, and monitor their users' activity in real time.

Can you give some examples of how the end result of this data is useful not just to the companies you count as clients, but ultimately to gig workers?

The result of our data centralization has a positive impact on increasing gig workers’ acceptance rate ultimately. Gig workers can struggle to justify their financial situation and affordability due to the fragmentation of their income proofs. It’s frustrating compared to traditional employees who only need to share a few payslips to be considered a good profile. Our infrastructure aims to reduce friction for gig workers and present a comprehensive application for various financial products.

Your service is live in multiple continents – pretty impressive for such a young company. How might the data you ingest, or the regulations around its use, vary from country to country?

Before launching in a new country, we spend time with local advisors to ensure our solution complies with data protection and security standards expectations. We have decided to apply the highest standards everywhere, even if the expectations are under some laws, such as the European GDPR, in some countries. For us, users’ data sharing must always be on a consent basis and for a clear purpose that end-users agree on.

Lastly, where will the gig workspace go in the next five years?

The gig economy is here to stay, and with the digital transformation of some industries, such as construction, we'll see the emergence of gig platforms that facilitate independent workers' access to new job opportunities. People have switched from leveraging some of their skills to work for a single employer to monetizing different skills simultaneously through gig jobs. We'll also see gig platforms accelerating their fintech roadmap by providing more financial benefits to their partners.

HOT INDUSTRY NEWS & GOSSIP

Uber delivers big Q2: We’re in the midst of quarterly earnings season, but let’s start off with some strong numbers from Uber. Gross bookings grew 19% YoY to $40 billion, with mobility up 23% and delivery rising 16%. Net income hit $1B on revenue of $10.7 billion. Even more interesting are some new developments to increase mobility to those that lack smartphones, such as a push into kiosks on Eastern Europe, the ability to order multiple rides at once (so you can call a cab for grandma) in India and a reinvigorated push for AVs.

Instacart’s up too: Grocery deliverer Instacart also had a quarter to crow about, with gross transaction value rising 10% YoY to $8.2 billion, leading to GAAP net income of $61 million on $823M of revenue. One little bump in the road — it lost a juicy credit card partnership with Chase, which has instead now teamed up with DoorDash.

Lyft lifted: Lyft’s Q2 makes the number two TNC look to be finally back to business, with gross bookings up 17% to $4 billion and revenue climbing a whopping 41% to $1.4 billion. The company scored its first ever GAAP profitable quarter, with net income coming in at a mighty $5 million. Looking ahead, Lyft is teasing a new feature called “Prime Lock” where users can pay a monthly subscription to guarantee lower fares during select surge pricing periods.

How cities use MDS: The Mobility Data Specification is now six years old, meaning municipalities have had plenty of time to incorporate the data standard into how they monitor and regulate shared transport options. With the tool’s capabilities growing, so too has the number of modes that cities use it for.

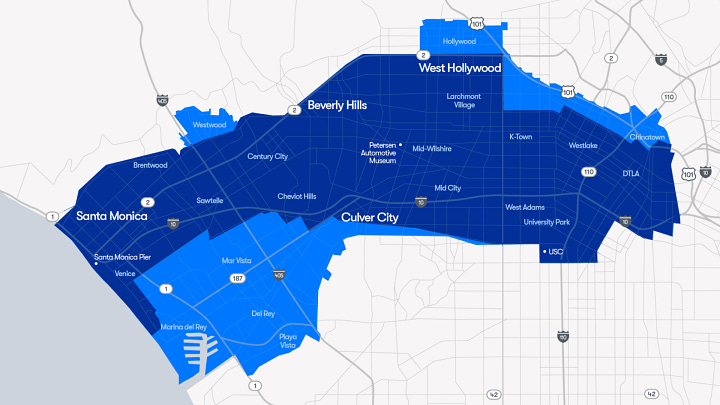

Mo’ Waymo: Robotaxi provider Waymo is rolling out a network expansion in both NorCal and SoCal. In SF, the expansion covers most of the 104,000 denizens of neighboring Daly City, as well as the 1.5 million deceased residing in Colma. (Hope they still have valid credit cards on file…) For LA, the expansion unlocks more of Hollywood, Chinatown, Westwood, and big swaths of Culver City and Marina del Rey.

It’s not your imagination: American police departments really have stopped enforcing traffic laws, and as an obvious consequence, road deaths have rapidly risen.

American exceptionalism: While America lets its transit systems stagnate, other countries continue to invest in their metros, as this new data hammers home. Add in complementary, modern services like S-Bahns and RERs and our shortcomings are even more obvious…

Green fleets: We’re seeing cities slowly electrify their vehicle fleets: work trucks, fire trucks, trash trucks, etc. Well now South Pasadena, CA can add police cars to that list, as the city and SCE have partnered to deploy a fleet of Tesla cop cars. And for those worried about range anxiety on a high speed pursuit, fear not: South Pas is only 3.42 square miles.

A few good links: Amazon pushes its delivery machine into rural areas. Chicago opens a beautiful new infill station on the CTA Green Line. BYD hopes to bring its reasonably sized EVs to Canada. Airbnb misses its earnings estimates. African ecommerce player Jumia raises $100M. New delivery options — Thistle, Mademeals, Feast & Fettle, Ipsa Provisions, Welcome Home, Chiyo, Sakara and The Daily Grocer — vie for wallets and stomachs. (But why do they all sound like an annoying restaurant that opened in 2012?) Midwestern favorite Culver’s launches on DoorDash. Bolt launches provocative ad campaign for Caromatherapy, reminding us just how much gas-powered cars stink.

Until next week!

- Modern Delivery & The Curbivore Crew