A Polycentric Post Pandemic Path Forward for Cities?

7/27 Webinar - EVs & P3s: New Solutions for Electrifying Our Cities

As we look to electrify the movement of both people and goods across our cities, there are a number of exciting opportunities for public and private actors to work together to accelerate the electric revolution. We'll hear from Tyrone Jue, Director of San Francisco Environment Department; Tom Schreiber, Founder & CEO of Perch Mobility; David Vega-Barachowitz, Associate Principal of WXY Architecture + Urban Design; and Julia Wunsch Delivery Public Policy Lead at Uber. They'll discuss a number of innovative policy, hardware, and design ideas — from charging pods to micro-EVs and everything in between — that are coming to a city near you.

A Post Pandemic Path Forward for U.S. Cities?

There are two recent pieces of research that I think offer important insights into the post-war history of American cities, as well as an analysis of emerging data that notes new patterns forming. “Boom Times or Doom Loop? America's Urban Future, Post-Pandemic” by former Deputy Commissioner for Traffic and Planning at NYCDOT offers a thorough data dive on each metro region’s last 70 years of development patterns; The Brookings Institute’s “Building for proximity: The role of activity centers in reducing total miles traveled” offers a more granular look at emerging nodes in varying regions. I think that by synthesizing the two, we can see some important patterns emerge for local leaders looking for an urban success story playbook.

Back to the future

While politicians and business leaders have spent the past three years fretting about population loss in major cities, in many ways that’s a revision to the post-war mean. From the 1950 census onward, central cities lost population, while subdivisions popped up and “metropolitan areas” sprawled wider and wider. While that trend reversed in some regions towards the end of 20th century, the pattern never really ceased in particularly disinvested regions like St. Louis or Cleveland.

Even many of America’s “urban success stories” never recovered their peak populations, even prior to recent pandemic losses. In the 2020 census, Manhattan’s population was 1,694,251; it peaked around a century earlier at 2,331,542. Boston may be one of the country’s wealthiest metro areas, but the city proper’s population in 2020 was still only about 84% of its 1950 peak. The same story holds in D.C., Chicago, Minneapolis, etc.

It’s not just a problem with cities that are cold/old. While many other municipalities “grew” post war, it’s an apples and oranges comparison. Sure Houston is almost 4x its 1950 population, and Phoenix a whopping 16x, but that’s because the population developed in places that had previously been uninhabited, or as the city annexed growing neighbors. If Chicago had simply absorbed Hoffman Estates and all the other tract home and office park communities that popped up around O’Hare, it too would have “grown” but the actual facts on the ground would have remained unchanged.

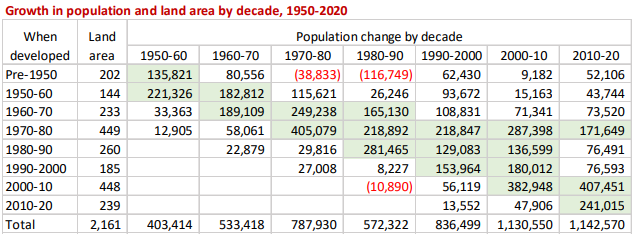

In fact, Schaller’s detailed analysis shows that in almost every metropolitan area, the parts of the region that were developed pre-1950 went into a steep population decline. Schaller calls these “central areas” and the story is stark: Houston’s 34.4 sq mi central area lost 22,000 people by 1990; in that same time Denver’s lost nearly 40%. Atlanta’s 11.2 square mile central area lost nearly 2/3s of its population and still has only recovered to less than 70% of its peak. It’s more or less the same story in other “high growth” cities like Phoenix, Indianapolis, Sacramento, Columbus, Jacksonville… a phenomenon truly agnostic to local politics or climate.

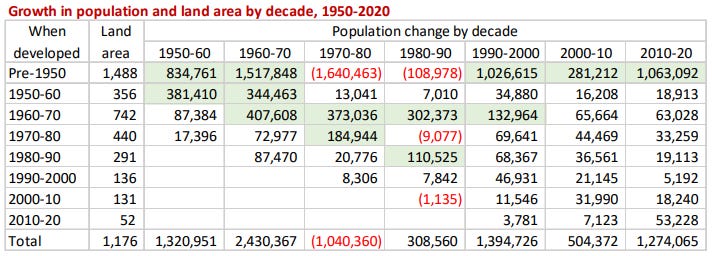

Look at the tumefacient growth of Houston above, but then note that the population was busily white-flighting itself out of the central area, peaking at a loss of 116,749 people in the ‘80s. In that way, it’s little different from the New York City region (below) or Chicago (second table.)

Learning from Los Angeles

There’s one exception to this rule: Los Angeles, ever the outlier. While the cores of every other American city shrunk, LA’s continued to grow. And while the region’s famously polycentric shape was visible back in the carhop days, the Schaller-defined central area (lightest pink) is a rather legible urban continuum stretching from Downtown to Santa Monica Bay.

While perhaps an unexpected finding for some, those facts are visible to anyone that’s ever strolled around Hollywood, Venice or Koreatown. Where else in the country will you find 19th century craftsmen next to an art deco midrise, with both mid-century dingbats and recent podium towers across the street?

Neighborhoods worth spending time in

While LA’s downtown is regionally not so important, it has dozens of other centers that look and operate the way you might expect of the CBD of a city just about anywhere else in the country. It’s that pattern that Brookings takes to calling “activity centers” and recommends that regions “build for proximity.”

It makes sense from both a sustainability and financial standpoint. Picture a suburbanite, whether on Long Island or 30 miles outside Houston. If they’re no longer heading to the downtown office, they’re far less likely to be in the city to go shopping, eat a meal, soak up some culture, etc. If their home community isn’t an activity center, they’ll instead have to drive miles and miles for each task, with no cohesive form uniting them all.

That’s the opportunity for both cities and businesses. It’s not that every block needs to look like Downtown San Francisco, rather that when you get off the Caltrain at say Atherton it should look more like Downtown Palo Alto than a sidewalk-less blob of McMansions. Work towards that, and regions will thrive.

HOT INDUSTRY NEWS & GOSSIP

Curb cuts: I was going to be laconic and evade the naming of names, but the writing’s now on the (LinkedIn) wall: two familiar players in the curb and mobility data space have seriously retrenched, one to the point of dissolution. If you’re hiring in this area, reach out and I’d be more than happy to put you in touch with some amazing folks!

Camera comeback: But there’s certainly some light at the end of the tunnel for companies measuring automotive behavior. After a few years of declines, speeding and red light cameras are returning to a number of streets, as cities look to cut down on traffic fatalities. Fun fact: the first speed cameras were installed way back in ‘87 in Arizona and Peoria (always Peoria!) while the first red light cameras came to NYC in ‘93. Of course Europe had them first.

Bezos’ Bloomberg moment: Jeff Bezos is channeling Mike Bloomberg for a moment, as the billionaire pours some philanthropic funds on his home planet, as opposed to his usual extraterrestrial ambitions. The Bezos Earth Fund announced a $400 million pledge to enhance green spaces in underserved U.S. communities. The Greening America’s Cities program is starting with a $50 commitment to improve community gardens and marginal green spaces in Albuquerque, Atlanta, Chicago, L.A., and Wilmington (Delaware.)

InDrive’s coming to America opportunity: Feel like bidding on your next ridehail trip? Want your driver poking at his or her phone to negotiate rates? If so, you’re in luck - as InDrive just launched in the U.S., starting in Florida. The formerly Siberian app is already popular in Latin America, South Asia, and parts of Africa.

Bikeshare booming! Shared bike systems are hitting their stride once more, as a number of operations in the U.S. have finally exceeded their pre-pandemic ridership numbers. Usage barely dipped during the height of Covid in NYC, Chicago and Boston, as commuters turned to it as an alternative to trains; ridership in those cities now is now a good 15-40% percent. DC and SF saw steeper declines, as more folks stayed home longer, but even there the numbers have almost caught up with their old records. Micromobility is looking less sanguine in the City of Bridges, as Spin had to pull its scooters out of Pittsburgh due to PA failing to renew the necessary pilot legislation.

Not so fast: AV innovators Cruise and Waymo are feeling the heat in SF, as local officials try to reign in their operations. While it’s up to the state, the CPUC seems to be feeling the pressure; a vote on expanding operations was deferred. Things aren’t truckin’ along for autonomous lorries either; the state is advancing a bill that would require safety operators in self-driving heavy duty trucks.

Fed up on fees? Restaurateurs and customers seem to have hit their limit on hidden markups, and its making an impact on the software players that are looking to finally achieve profitability. Both Toast and Clover had to walk back previously announced fee increases.

Hello Xoto: You got a sneak peak of their sleek tilting three-wheeled electric mopeds at Curbivore, but they’re now officially on sale: Xoto officially launched this week. If you’re in LA this weekend, check them out at the “EV Moto Takeover” Downtown.

UPS strike looms: There are about 11 days until UPS Teamsters’ contract expires, and the two sides don’t show any sign of backing down. While the logistics giant is training management to pick up the slack, the pilots union recently announced they would walk off in solidarity too; don’t expect to see Mark the Middle Manager maydaying an MD-11 in Miami. We’re looking at some significant parcel hiccups, as competitors like Fedex announce they don’t expect to be able to pick up UPS’ 24% share of the domestic market.

Ghosted: Uber Eats pulled the plug on 8,000 virtual restaurants. Unlike some of the higher profile brands walking away from the space, this was a culling of “lookalike kitchens” - where one operator puts up dozens of nearly identical listings, essentially spamming the marketplace.

Decongested: NYC MTA voted to raise the rates for subway and commuter riders, with base fares hitting $2.90 and vehicle tolls up 6%. With the agency looking to resume its tradition of raising rates every two years, expect this to slow a ridership recovery that’s currently stalled out at about 70% of the pre-pandemic numbers. While the gov’t recently OKed congestion pricing, that $1 billion in new funds is by law only allowed to pay for capital improvements, not operations. (Each billion dollars will pay for about one fifth of a mile of new metro, per the current Second Ave Subway budget. Only in New York, baby!)

A few good links: Grab snags Singaporean taxi competitor Trans-cab. Carvana successfully restructures debt, looks like those car vending machines are here to stay. Home chefs testing the limits of 3PD food safety standards. Getir may shutter U.K. superfast delivery ops. DOT announces urban electrification toolkit. Look both ways before crossing the highway - Tesla to license its ADAS tech to other OEMs.

Until next week!

- Jonah Bliss & The Curbivore Crew